Editor's PiCK

US SEC Abolishes 'SAB-121'... Opening the Path for Banks to Enter the Virtual Asset Industry

공유하기

- The U.S. Securities and Exchange Commission (SEC) has abolished 'SAB-121', making it easier for banks to enter the virtual asset industry.

- SAB-121 was an obstacle that required financial companies to treat the custody of virtual assets as liabilities.

- The synergy with Donald Trump's executive order is expected to further activate the integration of traditional finance and the virtual asset industry.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

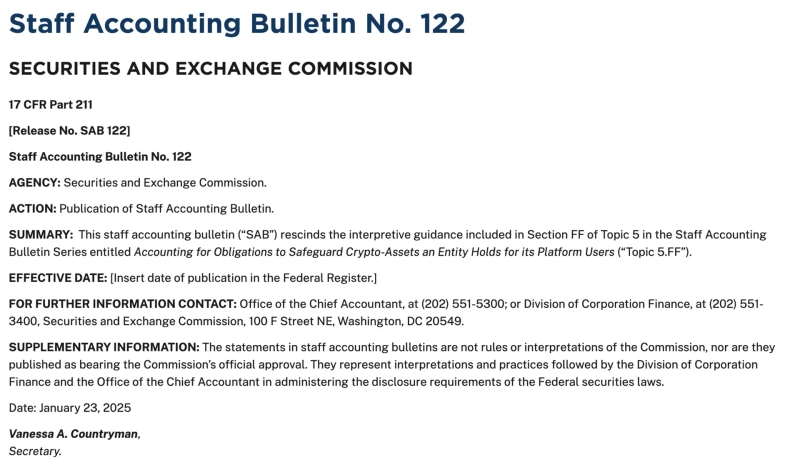

The U.S. Securities and Exchange Commission (SEC) has officially announced the abolition of the 'Virtual Asset Custody Accounting Guidance (SAB-121)'. It appears that the easing of government agency regulations on virtual assets (cryptocurrencies) is becoming official.

On the 23rd (local time), the SEC announced the abolition of SAB-121 on its website. SAB-121 was a regulation that required financial companies to record virtual assets entrusted to custodians as liabilities on their balance sheets, which has been pointed out as an obstacle preventing banks from entering the virtual asset market.

Meanwhile, with the abolition of SAB-121 and the signing of a virtual asset executive order by U.S. President Donald Trump, the integration of traditional finance and the virtual asset industry is expected to become more active. The executive order aims to establish a working group to propose regulations and legislation on the virtual asset market.

![2025-12-24 [Javis] 'PICK News Image5 Reporter Taek'](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)