Editor's PiCK

Oh?!

공유하기

- President Trump's imposition of import tariffs has increased uncertainty in global financial markets, leading to a record high in gold prices.

- China's policy allowing insurers to purchase gold is enhancing the safe asset appeal of gold, supporting its price rise.

- Goldman Sachs noted that hedge funds are showing a bullish shift in the U.S. stock market, with growing interest in AI-themed stocks.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

(Bloomberg) — As President Trump announced a 25% import tariff on steel and aluminum and the introduction of reciprocal tariffs, investors flocked to safe assets. The dollar was slightly stronger against most G10 currencies, and notably, gold surged over 1.7% at one point, breaking through the $2,900 per ounce mark to hit a new record high. MUFG assessed that "the increased risk of greater disruption to global trade due to additional tariff hikes supports the dollar." However, the New York Stock Exchange rebounded with a tech rally, and in the short term, the U.S. Consumer Price Index and remarks from Fed Chair Powell, due this week, are in focus.

Overnight, the dollar-won exchange rate (BGN) closed around 1,451 won, down 3.2 won from the previous trading day, showing relative resilience of the won. In Korea, optimism seems to be at play that the impact of Trump's tariffs may not be as significant as expected. Bloomberg economist Kwon Hyo-sung assessed that while the steel industry, which accounts for about 13% of the U.S. export market, would be hit, the overall impact on the Korean economy would not be significant. Barclays also predicted that the impact on Korea could be greatly reduced due to the different composition of trade items between Korea and the U.S. The following are major issues that market participants may be interested in.

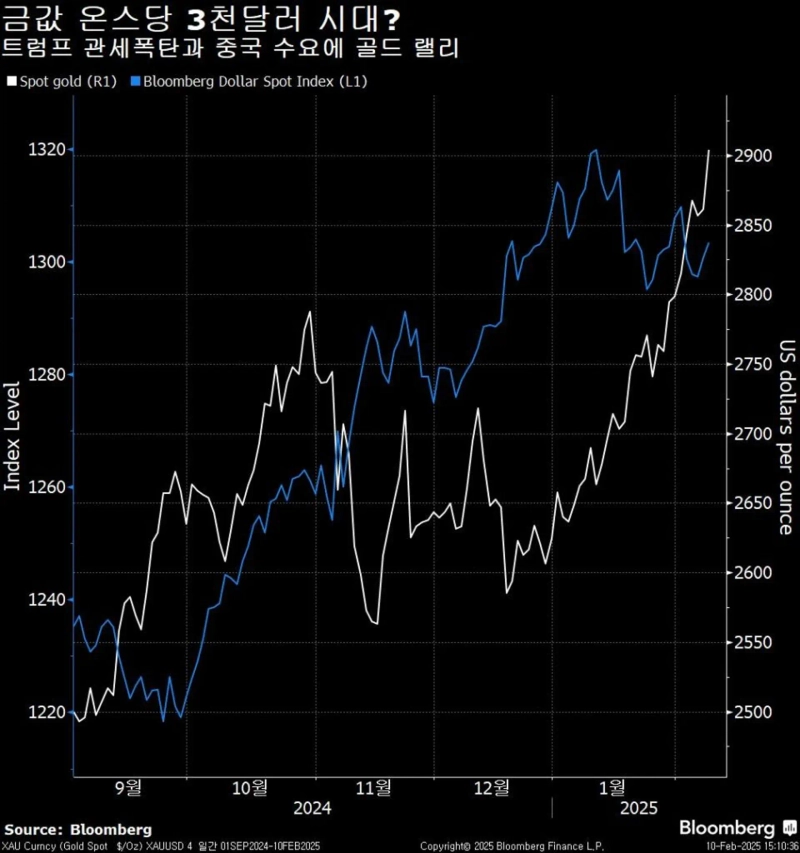

Gold Prices Near $3,000 on Trump Tariffs, China Demand

As Trump announced various tariffs, adding uncertainty to global financial markets, and China allowed insurers to buy gold, gold prices hit an all-time high. Spot gold prices soared to $2,911 per ounce on Monday, and if Trump's tariffs continue to shake the market, $3,000 seems only a matter of time. China's authorities launched a pilot program last Friday allowing 10 domestic insurers to invest up to 1% of their assets in gold. Minsheng Securities estimated that this could affect funds amounting to about 200 billion yuan ($27.4 billion).

Moreover, the People's Bank of China (PBOC) increased its gold holdings for three consecutive months until January this year, indicating a continued push for diversification of foreign exchange reserves despite gold prices being at record levels. Historically, China has tended to continue buying gold for several months once it starts. Notably, during Trump's first term, the PBOC increased its gold holdings for about 10 consecutive months. Westpac Banking stated, "Gold is still in a good position, with little to hinder it," and "the inherently unpredictable and disruptive Trump, threatening tariffs on both allies and adversaries, and warning BRICs of a 100% tariff if they attempt de-dollarization, all enhance gold's appeal as a safe asset."

European Gas Prices Hit Two-Year High

European natural gas prices hit a two-year high, and with inventories rapidly depleting, Europe is at risk of falling back into an energy crisis. The Dutch TTF futures, which have risen for four consecutive weeks, surged 5.4% at one point on Monday to €58.75 per megawatt-hour, the highest since February 2023. With the cold weather continuing in Northwest Europe, heating demand is likely to sustain the early-year rally in natural gas.

The risk of gas stockpiles being depleted due to increased fuel consumption is present, with inventories already at 49% of total storage capacity, compared to 67% during the same period last year. According to ICIS's monthly outlook, European gas consumption is expected to increase by 17% year-on-year, driven by residential and commercial demand. ICIS predicted that end-of-winter inventories would be only 37%. Global Risk Management reported that not only near-term but also 2026-2027 futures prices have risen.

Goldman Sachs: 'Hedge Funds Shift to Bullish View on U.S. Stocks'

As corporate earnings came out stronger than expected, hedge funds are abandoning their previous bearish outlook on the U.S. stock market. According to Goldman Sachs' prime brokerage report for the week ending February 7, hedge funds ended five consecutive weeks of net selling and bought U.S. stocks at the fastest pace since November last year. Particularly, the information technology sector, focusing on software and semiconductor stocks, recorded the largest net buying since December 2021.

Regarding this move, Vincent Lin, co-head of Prime Insight and Analysis at Goldman Sachs, noted in an investor memo, "It suggests that hedge funds have started to take a more active interest in the AI theme following the DeepSik sell-off on January 27." John Flood, partner and head of Americas Equity Sales Trading at Goldman Sachs, pointed out, "In an uncertain macroeconomic environment, micro data has signaled another strong earnings season."

Trump's Gaza Plan Hints at Possible U.S. Debt Reduction

Trump stated in his Gaza plan that Palestinians would not be guaranteed the right to return to that territory. In a Fox News interview, when asked if they have the right to return to Gaza, he replied, "They will have much better housing, so no." He said it would take years to rebuild Gaza, and instead, he would relocate them to other "safe communities" and develop Gaza as "real estate for the future that I own." This is likely to provoke anger from Palestinians and many countries around the world.

Meanwhile, Trump said that Elon Musk's Department of Government Efficiency (DOGE) found something unusual while examining Treasury Department data, which could mean "the debt might be less than thought." It is unclear whether he is talking about U.S. government debt or payments processed through the Treasury. An anonymous administration official said that DOGE's review and improvement of the Treasury's payment system could reduce future deficits and debt.

BP Shares Surge on Elliott's Stake Acquisition

BP shares surged after a Bloomberg report that Elliott, one of the world's most aggressive activist funds, had acquired a significant stake in BP. In Monday's London trading, BP jumped over 8.2% at one point to trade at 468.9 pence, the largest gain since 2020. BP has gone through ups and downs over the past 15 years, from the Deepwater Horizon spill to the sudden dismissal of CEO Bernard Looney, who caused internal scandals.

According to sources familiar with the matter, several competitors are crunching the numbers on a potential BP merger or acquisition. It is unclear if anyone is seriously considering a merger or acquisition, but the fact that such talks are happening shows how far BP has fallen. Biraj Borkhataria, an analyst at RBC Europe, said, "If it's an activist fund, they would at least demand a change of BP's chairman."

For inquiries related to the article:

Daedo Kim (London), dkim640@bloomberg.net;

Eunkyung Seo (New York), eseo3@bloomberg.net

![2025-12-24 [Javis] 'PICK News Image5 Reporter Taek'](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)