Short selling to resume for all stocks next month... More 'overheated stocks' to be designated

공유하기

- Short selling will resume for all listed companies at the end of next month, according to Financial Services Commission Chairman Kim Byung-hwan.

- The requirements for designating overheated stocks will be eased to attract foreign investors and minimize market volatility.

- Expectations for inclusion in the MSCI Developed Markets Index are growing, and the resumption of short selling is expected to have a positive impact on foreign investment inflows.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

For the first time in 5 years since the COVID crisis

Kim Byung-hwan: "Considering international credibility"

Short selling will be allowed for all listed companies starting from the end of next month. This comes 5 years after it was completely banned in March 2020 due to the COVID-19 impact.

Kim Byung-hwan, Chairman of the Financial Services Commission**(pictured)**, said at a regular press briefing at the Government Complex Seoul on the 24th, "When short selling resumes, our position is to allow it for all stocks," adding, "If the system check confirms there are no issues, we will fully resume it on the 31st of next month."

Short selling is a transaction that generates profit by borrowing and selling shares of stocks expected to decline in price. After the pandemic, when market volatility increased, it was completely banned, then partially allowed in May 2021 for 350 stocks included in the KOSPI 200 and KOSDAQ 150 indices. In November 2023, it was completely banned again following illegal naked short selling incidents, but there were criticisms about significant side effects such as foreign investor exodus. Chairman Kim emphasized, "When short selling was partially allowed, we resumed it mainly for stocks with many foreign investors," adding, "Since we've spent over a year improving the system and regulations, there's no reason to resume it for only some stocks." He also added, "We must also consider our international credibility."

The authorities have decided to temporarily ease the requirements for designating 'overheated short selling stocks' to minimize volatility in individual stocks. Chairman Kim said, "We will ease the criteria for a month or two so that more stocks can be designated as overheated stocks." When designated as an overheated stock, short selling is automatically prohibited on the next trading day.

Kim Byung-hwan: "It's time for bank loan interest rates to come down"

'Full resumption of short selling', "Interest rates should be determined by market principles"

Interpretations suggest that Financial Services Commission Chairman Kim Byung-hwan's announcement on the 24th about resuming short selling for all stocks is a 'message of courtship' aimed at foreign investors. This is because there is a widespread perception among overseas institutions that 'a stock market where short selling strategies cannot be used is unfair.' However, he now faces the challenge of appeasing individual investors who have been concerned about stock index declines after short selling is allowed. Regarding bank interest rate practices, Chairman Kim urged a reduction in loan interest rates, saying, "The base rate cut should be reflected in loan interest rates."

Expectations for inclusion in developed market indices likely to increase

At the press conference, Chairman Kim said, "Even if short selling is fully resumed from the end of next month, its impact on the overall capital market will be short-term," adding, "I am also aware of concerns that short selling might concentrate on certain individual stocks."

This is also why he announced the temporary easing of requirements for designating overheated short selling stocks. He said, "We will be able to discuss specific easing criteria next month as we need to examine the impact and effects of short selling through past data." This suggests the number of stocks designated as overheated for short selling could increase.

South Korea is the only developed stock market that has completely banned short selling. While it was a measure to block unfair trading, there have been many criticisms that Korea is missing out on the positive functions of short selling, which provides liquidity to the market and prevents overheating. One of the reasons for repeatedly failing to be included in the MSCI Developed Markets Index, a long-cherished wish of the securities industry, was the short selling ban.

According to the Bank of Korea, foreign investors withdrew a total of 2.6 trillion won from the stock and bond markets last month. Lee Hyo-seop, a research fellow at the Capital Market Research Institute, said, "Just being included in the MSCI Developed Markets Index could lead to net purchases by foreign investors worth up to 60 trillion won."

Some observers predict that the short selling ban might be reconsidered due to political demands. Even within the Financial Services Commission, there have been considerations to ban short selling if the stock index falls 15-20% compared to the average of the previous three months. A capital market insider pointed out, "Along with the full resumption of short selling, clear guidelines on short selling policy must be issued to bring back foreign investors."

"Checking if interest rates follow market principles"

Regarding questions about the bank 'interest profit controversy,' Chairman Kim responded, "It's time to lower loan interest rates." While acknowledging that "there is a time lag for base rate cuts to be reflected in the market, and there were household debt management issues at the end of last year," he emphasized, "I think it's now time for banks to reflect this." He added, "In that respect, the Financial Supervisory Service is checking whether interest rate decisions are being made according to market principles."

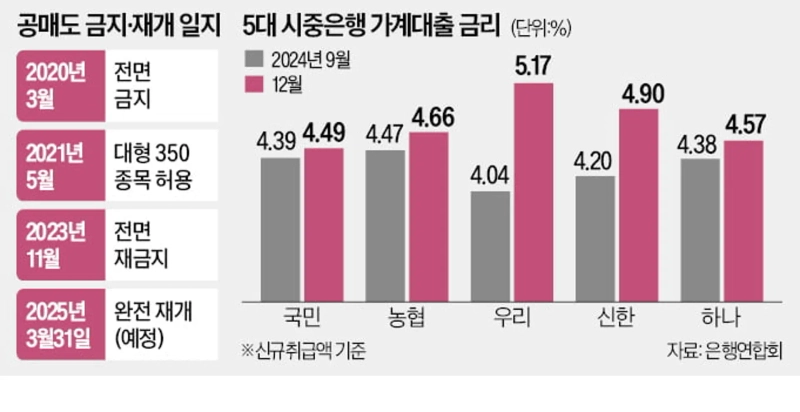

According to the Korea Federation of Banks, the average household loan interest rates of the five major commercial banks (KB, Shinhan, Hana, Woori, and NH) for new loans in December last year ranged from 4.49% to 5.17% annually, which is actually 0.45-0.7 percentage points higher than in September (4.04-4.47% annually) before the rate cut. On the 21st, the Financial Supervisory Service requested banks to submit data on benchmark and add-on interest rate changes by borrower and product, along with justifications and preferential interest rate application status.

Regarding the recent fee issues that have emerged as card companies move to introduce Apple Pay, he said, "This is not an issue for financial authorities to intervene in," but added, "We will closely monitor the market situation to ensure that the burden is not transferred to merchants and consumers."

He also sent a kind of 'warning' to Lotte Non-Life Insurance, which applied an exception model for the accounting treatment of non-surrender value insurance. Chairman Kim stated, "If exceptions are allowed without sufficient grounds, there will be too many exceptions," adding, "The supervisory authorities will check whether there are acceptable grounds."

Yang Hyun-ju/Choi Seok-cheol/Shin Yeon-soo reporters hjyang@hankyung.com

![2025-12-24 [Javis] 'PICK News Image5 Reporter Taek'](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)