Breaking

'The Powerful Trump Rally' Isn't Over Yet... "Bitcoin to Resume Rally if it Breaks 97.5k" [Kang Min-seung's Trade Now]

공유하기

- Experts predict that if Bitcoin breaks the $97,500 resistance level, the bull market is likely to continue.

- The US Department of Commerce's core PCE indicator supported the Fed's cautious stance on rate cuts, and Trump's policy could affect rate cuts.

- BlackRock's Bitcoin ETF option showed strong demand and is expected to significantly increase market liquidity.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

“Bitcoin Expected to Rise if it Breaks 97.5k Stably"

"Possibility of Increased Decline if it Falls Below 89.8k"

Bitcoin (BTC), which surged 47% after Donald Trump, who calls himself the 'Crypto President', was elected as the US President, is attempting to rise again near $95,000 after a short-term correction.

Market experts have analyzed that if Bitcoin stably breaks $97,500, it is likely to continue the bull market, but if it gives up the support level of $89,800, the possibility of further decline increases.

As of 17:58 on the 28th, Bitcoin is trading at 133.07 million won on the Upbit KRW market (equivalent to $95,449 on the Binance USDT market), up 0.06% from the previous day. At the same time, the Kimchi Premium (the price difference between overseas and domestic exchanges) showed a reverse premium, recording -0.55%.

“US Inflation Indicator Rises Again… Cautious Stance on Additional Rate Cuts”

Recently, global stock markets showed a slight decline as the inflation indicator, which the US Federal Reserve (Fed) focuses on, stopped its slowdown and rose again. However, it seems to have not significantly affected the overall market flow, including cryptocurrencies. This is because the economic indicators met market expectations and did not interfere with the Fed's interest rate policy.

On the 27th, the US Department of Commerce announced that the core Personal Consumption Expenditure (PCE) price index in October rose 2.8% from a year ago and 0.3% from the previous month. The core PCE met market expectations but recorded the highest level in six months since April this year. Specifically, the sharp rise in service prices has fueled inflation concerns.

The core PCE, excluding volatile food and energy prices, is considered a key indicator that the Fed refers to before making policy considerations such as interest rate decisions.

The market expects that the announced indicator will support the Fed's cautious stance on rate cuts. The US Consumer Price Index (CPI) for October, announced earlier, reversed its upward trend for the first time in seven months, and the Producer Price Index (PPI), known as wholesale prices, also paused its slowdown, raising concerns about inflation. Additionally, Jerome Powell, the Fed Chair, suggested the need to be cautious about rate cuts, indicating a need for speed adjustment.

On this day, US economic media CNBC reported, “The core PCE for October showed stronger figures. The stock market showed mixed trends upon the announcement of the indicator, and bond yields fell.” Bloomberg stated, “US inflation still appears stubborn, and it seems it will take more time to approach the Fed's target of 2%,” but also predicted, “The (actual) rate cut path could be complicated by Trump's policy direction.”

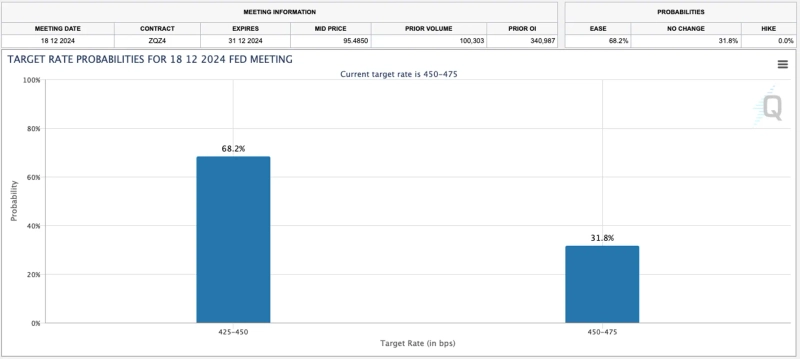

Meanwhile, the interest rate futures market is raising the possibility of a rate cut in December. According to the CME FedWatch at 18:00 on this day, the possibility of the Fed cutting the base rate by 0.25 percentage points in December rose by about 9 percentage points from the previous day to 68.2%. On the other hand, the possibility of maintaining the rate was reflected at 31.8%.

BlackRock's Bitcoin Option 'Spectacular Debut'… “Liquidity Increase and Institutional Adoption Expected”

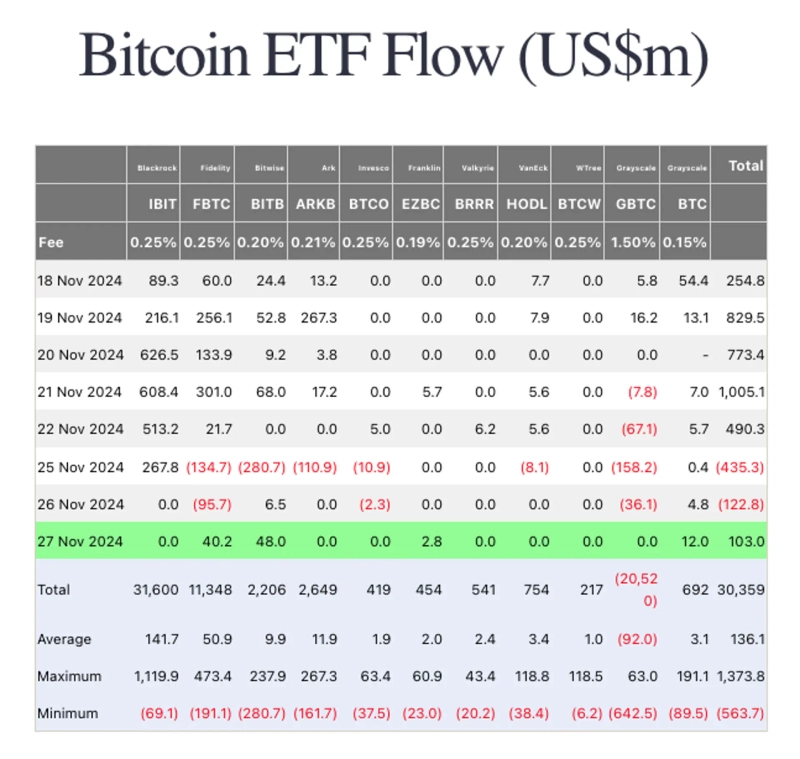

The Bitcoin spot exchange-traded fund (ETF) achieved a record inflow of $3.3531 billion (about 4.6708 trillion won) last week (18th-22nd), but showed net outflows for two consecutive trading days thereafter. The recent news that the Trump administration is expanding pro-crypto personnel, MicroStrategy's additional purchase of 55,500 BTC, and Gary Gensler, the US Securities and Exchange Commission (SEC) chairman, expressing his intention to resign, have contributed to the upward trend.

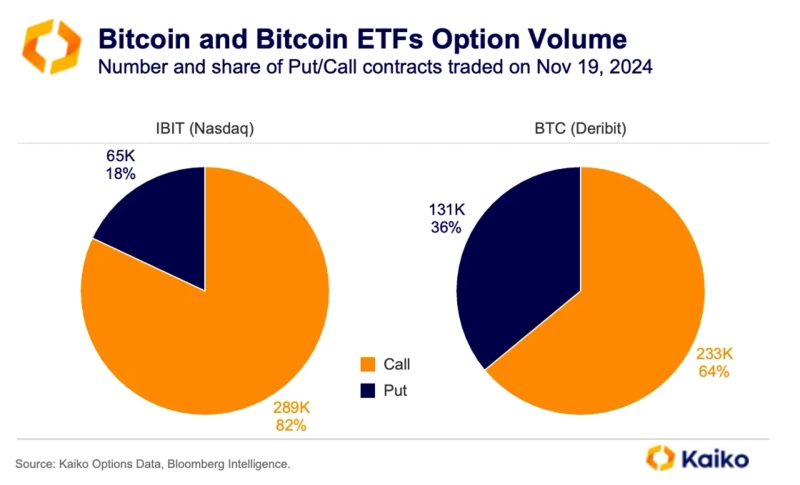

In particular, as BlackRock's Bitcoin option was listed on the New York Stock Exchange, optimism spread significantly. Crypto data analysis firm Kaiko stated in a recent research report, “BlackRock's Bitcoin spot ETF option, listed last week, recorded a trading volume of about $1.9 billion on the first day of trading,” adding, “80% of it was composed of call options betting on price increases, indicating strong investor demand and bullish outlook.”

Kaiko stated, “Several option products launched based on the recent Bitcoin spot ETF can significantly increase market liquidity and accelerate institutional adoption,” adding, “The momentum of institutions in the (crypto) derivatives market is expanding. Last week, the open interest (OI) of Bitcoin futures on the Chicago Mercantile Exchange (CME) also continued to hit record highs at about $22 billion (about 30.679 trillion won).”

Open interest refers to contracts in derivatives such as futures and options that have not yet been settled. An increase in open interest means that funds are flowing into the market. In particular, large institutional investors mostly trade on the CME rather than typical coin exchanges.

“Long-term Investors Taking Profits, Possibility of Increased Selling Pressure… Mid-term Uptrend Expected”

Contrary to the optimistic market atmosphere, there is also a forecast that additional selling pressure from long-term investors may be introduced. On-chain analysis platform Glassnode stated in its weekly report on the 26th, “Bitcoin has come very close to $100,000, and long-term investors are engaging in large-scale selling.”

It continued, “Long-term investors who have held Bitcoin for more than six months but less than a year have seen unrealized profits surge due to the recent explosive uptrend and sold 507,000 BTC.” The report added, “If Bitcoin's price rises further, the selling pressure from long-term investors who have held Bitcoin for more than a year is likely to continue.”

Global crypto exchange Bitfinex stated in its weekly research report, “Since Bitcoin broke through the previous high (73,666 dollars) last month, long-term investors have sold more than 461,000 BTC so far,” diagnosing, “Although the selling pressure is increasing, it is still lower compared to the selling pressure during the bull market in March 2021.” It continued, “The upward momentum may temporarily stagnate, but it seems to be a 'healthy breather'. The market is likely to absorb the selling pressure and continue the uptrend in the mid-term.”

Despite investors realizing profits, the overall trading volume continues to increase. Crypto data analysis firm Santiment stated on the 27th, “November's on-chain trading volume has been actively increasing. Especially on the 12th, the trading volume reached 154.92 billion BTC, hitting a peak since May.” It also explained, “After Bitcoin reached an all-time high, investors are realizing profits and funds are quickly moving to altcoins,” adding, “The overall (crypto market) trading volume surged by 32% in the last week of this month.”

Meanwhile, posts predicting both bullish and bearish trends for Bitcoin are increasing on social network services (SNS) such as Twitter and Reddit. Santiment stated, “Recently, mentions of Bitcoin reaching $100,000 have increased significantly on Twitter, reflecting investors' fear of missing out (FOMO) in a rising market.” It also analyzed, “Mentions of Bitcoin returning to the 60-79k price range are stimulating fear, uncertainty, and doubt (FUD), but are also acting as a catalyst for market growth.”

“Bitcoin Expected to Continue Uptrend if it Stably Breaks $97,500”

Market experts predict that if Bitcoin breaks the $97,500 resistance level, it is likely to continue the uptrend. On the other hand, they also analyzed that if Bitcoin breaks below the $93,500 support level, the possibility of further decline increases. On-chain analysts have analyzed that the buying power in the market is increasing as stablecoins flowing into major exchanges exceeded $9.7 billion (about 13.5 trillion won) in the past month.

Bitcoin started to rise again after giving up the short-term support level and falling to around $90,000. Ayushi Jindal, a NewsBTC researcher, stated, “Bitcoin started a short-term correction near $97,500 and is rising again after bottoming out at $90,736,” adding, “If Bitcoin breaks the $95,750 resistance level, a significant rise could begin.”

The analyst added, “If Bitcoin continues the uptrend, it could test the $97,500 level and reach $98,000,” but also warned, “If Bitcoin falls below $93,500, it could retreat to $91,800 and $90,500. If it gives up $90,000, the decline could expand to $88,000.”

Rakesh Upadhyay, a Cointelegraph researcher, predicted, “If Bitcoin breaks the 'psychological resistance' of $100,000, it could expand its rise to $113,331 and $125,000.” He added, “If Bitcoin breaks below $89,857 on a daily basis, the optimistic outlook becomes invalid. It could fall further to $85,000.”

Upadhyay stated, “Despite the massive fund inflow into Bitcoin spot ETFs and MicroStrategy's additional purchases, Bitcoin's failure to break the $100,000 barrier could trigger selling pressure from short-term investors,” adding, “If it fails to break $100,000 again, a strong pullback could occur.”

There is also an observation that buying pressure is re-entering as Bitcoin successfully rebounds from a short-term decline. Alex Kuptsikevich, an FXPro market analyst, stated, “Recently, Bitcoin fell about 9% from its peak amid investors' profit-taking and the cautious atmosphere of the global stock market,” but added, “As the market rebounds, buying pressure is returning, and expectations are growing that the correction will end.”

Meanwhile, there is also an analysis that funds chasing profits are moving from Bitcoin to altcoins. He diagnosed, “This Bitcoin correction is not due to a fundamental deterioration in sentiment towards Bitcoin. The impact is significant as Bitcoin investors move to altcoins chasing profitability.”

He added, “Altcoins are leading the recovery of the current crypto market, and Bitcoin is expected to follow.” According to the Blockchain Center on this day, the 'Altcoin Season' index, a strong indicator of altcoins, rose by 28 in a week to 61, hitting the highest level since April.

Kang Min-seung, Bloomingbit Reporter minriver@bloomingbit.io