Why Can't This Friend Be Summarized - General News

공유하기

- Ripple (XRP) is expected to rise further if it breaks $2.75, but if it falls below $2.5, further decline is possible.

- Ripple and other altcoins have surged on the news of SEC Chairman Gensler's resignation, with increased fund inflows and trading volume.

- There are observations that the cryptocurrency market will continue to rise due to President-elect Trump's crypto-friendly policies.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

“Ripple Expected to Continue Rising if It Stably Breaks $2.75”

“Possibility of Further Decline if It Falls Below $2.5”

Image = Shutterstock

After Gary Gensler, the chairman of the U.S. Securities and Exchange Commission (SEC), known as the 'Cryptocurrency (Virtual Asset) Grim Reaper,' announced his resignation in January next year, altcoins (virtual assets other than Bitcoin), including Ripple (XRP), have been on the rise. Market experts have analyzed that the influx of funds and trading volume in the altcoin market is rapidly increasing, raising expectations for a rise.

As of 1:25 PM on the 4th, the price of XRP is trading at $2.5573 on the Binance USDT market, down 7.11% from the previous day. At the same time, the relative value of Ripple compared to Bitcoin (XRP/BTC) fell by 7.05% from the previous day.

On this day, Bitcoin (BTC) dominance (the proportion of Bitcoin in the total market capitalization of cryptocurrencies) is 55.19%, showing a downward trend over the past week. The recent rise in Bitcoin prices and the resulting decrease in dominance can be interpreted as many altcoins outperforming Bitcoin.

Meanwhile, the Kimchi Premium (the price difference between overseas and domestic exchanges) of major virtual assets such as Bitcoin is recorded at -0.57%. In the domestic market, virtual assets are being traded at slightly lower prices than global prices.

“Ripple Soars on Gensler's Resignation News…Expectations for Spot ETF and Stablecoin Launch↑”

Image = Gary Gensler X Capture

Since Gary Gensler, the SEC chairman who was unfriendly to virtual assets, announced on the 22nd of last month that he would resign in January next year, several altcoins, including Ripple, which had been embroiled in securities controversy, have recorded explosive growth rates. Chairman Gensler is scheduled to resign on the day Trump takes office (January 20 next year). After the news was delivered, Ripple surged by 125% until today and rose to the 3rd place in the market capitalization of virtual assets. During the same period, Stellar (XLM) rose by 123%, and Algorand (ALGO) by 172%.

Expectations are growing that Ripple may launch a spot exchange-traded fund (ETF) and its own stablecoin 'RLUSD'. Previously, Bitwise, Canary Capital, 21Shares, and WisdomTree submitted applications for Ripple spot ETFs. There are also forecasts that the issuance of Ripple spot ETFs by U.S. asset management companies could accelerate. Nate Geraci, CEO of ETF Store, said, “It is expected that the number of Ripple spot ETF issuers (submitting applications) will continue to increase in the future.”

Additionally, on the 1st, U.S. economic media Fox Business quoted sources as saying, “The New York Department of Financial Services (NYDFS) is likely to approve Ripple's stablecoin RLUSD soon.” The crypto-specialized media The Crypto Basic predicted, “RLUSD is likely to utilize XRP as its own reserve,” adding, “This will have the effect of maintaining the circulating supply of XRP while reducing the total supply.” The launch of Ripple Labs' RLUSD could be a positive factor for boosting Ripple's price.

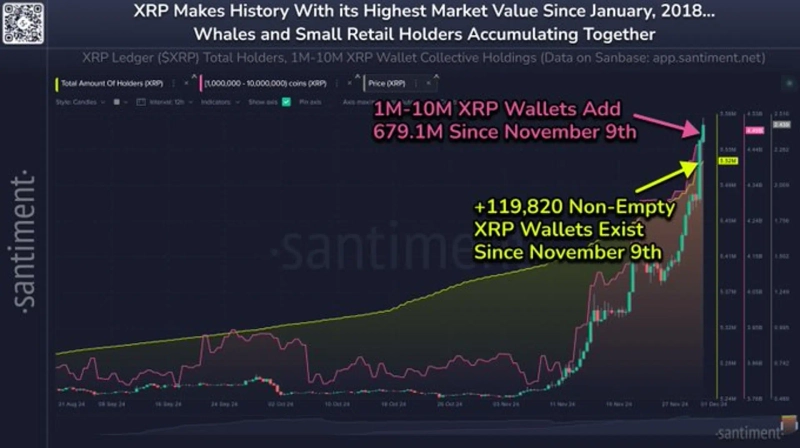

Both whale investors and individual investors have accumulated a large amount of Ripple over the past three weeks / Image = Santiment X Capture

As optimistic prospects spread, the buying trend for Ripple has been strongly inflowing into the market. On the 2nd, the virtual asset data analysis company Santiment announced on X (formerly Twitter), “Investors holding between 1 million and 10 million Ripples have accumulated 679.1 million XRP over the past three weeks.” The Ripple they accumulated is worth $1.66 billion (about 2.33 trillion won). Santiment added, “As both whale investors and individual investors have recently accumulated quantities, Ripple's price has reached its highest level in about 7 years since 2018.”

Meanwhile, as U.S. President-elect Donald Trump is expected to implement crypto-friendly policies, there are also observations that the cryptocurrency market will continue to rise. On the 2nd, Bloomberg reported, “Trump is expected to create a favorable environment for digital assets,” adding, “Trump has declared that he would create crypto-friendly regulatory agencies, and after Trump won the presidential election, the market value of cryptocurrencies increased by about $1.2 trillion (about 1,683 trillion won).”

‘To the Moon’ Ripple, Surged Over 360% in a Month…Will It Reach $3 at This Rate

Image = Shutterstock

Market experts predict that if Ripple stably breaks $2.75, it is highly likely to continue rising, but if it falls below $2.5, the possibility of further decline increases. On-chain analysts have analyzed that whale investors are recently transferring large amounts of Ripple to exchanges.

Recently, Ripple is catching its breath and challenging for further rise. Ayush Jindal, a researcher at NewsBTC, said, “Ripple is aiming for further rise as it hits a short-term peak at $2.869 and consolidates near $2.7,” adding, “If Ripple breaks the resistance line of $2.75, it is highly likely to continue rising. The resistance lines for the rise are located at $2.85, $2.96, and $3.”

The analyst added, “If Ripple fails to break the resistance line, it could fall to $2.65 and $2.52,” adding, “If it breaks below $2.52, it could fall further to $2.45 and $2.3.”

There are also forecasts that Ripple has entered the overbought zone and volatility may increase for the time being. Rakesh Upadhyay, a researcher at Cointelegraph, predicted, “Ripple is likely to reach $3 as it rises after breaking the major resistance of $1.97. After that, it could test $3.84.”

He added, “Ripple has entered the overbought zone with a rapid rally over the past few days, and the possibility of a sharp retracement has increased,” adding, “Investors should be prepared for increased volatility and be cautious.” If Ripple undergoes a short-term adjustment, the area around $2 is expected to be a key support line.

There are also forecasts that the soaring Ripple is expected to realize profits for long-term investors. Alex Kuptsikevich, a market analyst at FXPro, analyzed, “XRP has surged 360% over the past 30 days, and the price is flying to the moon,” adding, “Coins such as Ripple and Litecoin are rising on expectations that the U.S. will ease regulations. In the futures market, a ‘short squeeze’ is occurring, boosting their upward momentum.”

The analyst added, “The current price level seems to be a good point for long-term investors to realize profits and sell their holdings,” adding, “On the other hand, for new and short-term investors, the risk (of entry) may be high.”

Meanwhile, a short squeeze refers to when investors who shorted Bitcoin buy it to cover their short positions or reduce losses when the price rises.

Altcoin Market, Market Cap and Trading Volume Surge…Has the ‘Altcoin Season’ Begun

While the leading cryptocurrency Bitcoin (BTC) is catching its breath ahead of $100,000, the trading volume and market capitalization of altcoins (cryptocurrencies other than Bitcoin) are increasing significantly. As expectations for an altcoin rebound rise, there are forecasts that the altcoin cycle is imminent.

The market capitalization of virtual assets excluding Bitcoin and Ethereum is surging. / Data = Bitfinex

On the 25th of last month, the global virtual asset exchange Bitfinex stated in a research report, “The total market capitalization of altcoins continues to rise recently, approaching the highest level of $984 billion (about 1,372 trillion won) in May 2021,” adding, “The shift of investment funds from Bitcoin to altcoins is signaling the start of the 'altcoin season.'”

The report continued, “In particular, the market capitalization of altcoins excluding Bitcoin and Ethereum has recently surged, showing the largest increase since April 2021,” adding, “(With the inflow of funds) large-cap 'blue-chip' altcoins such as Solana have broken through major resistance levels and hit all-time highs.” The report predicted that the momentum of altcoins will be further strengthened as the participation of individual investors increases recently.

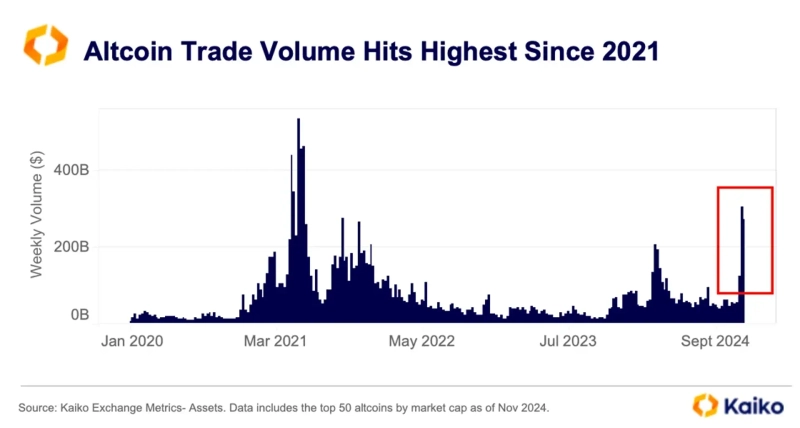

Altcoin Trading Volume / Data = Kaiko

As the trading volume of altcoins increases significantly, expectations for a rebound are also rising. The virtual asset data analysis company Kaiko analyzed, “The proportion of altcoin trading volume in the total virtual asset trading volume has soared to 74%, hitting a 3-year high,” adding, “Altcoin trading volume has started to surge from early November. The virtual asset market has been led by Bitcoin, but recently, risk appetite has increased further.”

According to Kaiko, the weekly trading volume of the top 50 altcoins by market capitalization recorded $305 billion (about 425 trillion won) in early November, the highest level since October 2021.

Alex Kuptsikevich, a market analyst at FXPro, analyzed, “After Bitcoin underwent a short-term adjustment, the rebound of altcoins continued,” adding, “As investors move to altcoins such as Ethereum, the altcoin season index has also risen sharply.”

On this day, according to the Blockchain Center, the ‘Altcoin Season’ index, a strong indicator of the altcoin market, rose by 23 to 86 in a week, recording the highest level since March. The altcoin season index is considered to have arrived when it surpasses 75.

There are also analyses that the volatility of the altcoin market may intensify for the time being. Michael van de Poppe, a virtual asset strategist, predicted, “The virtual asset market is entering a bull market. The value of altcoins compared to Bitcoin is likely to continue to rebound,” adding, “The revived momentum could lead to increased volatility.”

Kang Min-seung, Bloomingbit reporter minriver@bloomingbit.io