Testing

공유하기

- It was revealed that there is a growing trend of cryptocurrency projects attempting to combine AI and blockchain.

- Decentralized GPU projects are evaluated as an efficient alternative to solving the essential GPU acquisition problem for AI developers.

- EMC combines GPU rental services with DeFi to offer a return of about 2.7~7.1%, and the revenue outlook for GPU rental services could increase by at least 30% to a maximum of 200%.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

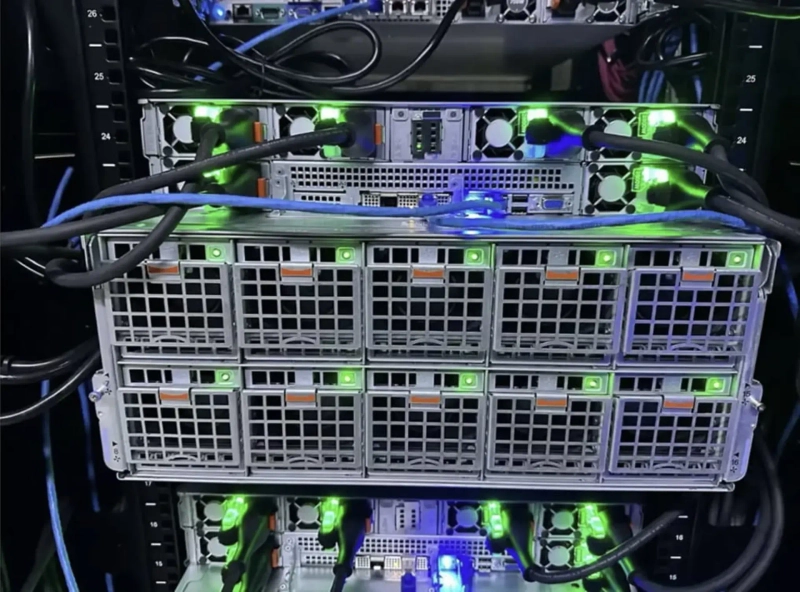

Photo provided by EMC

As interest in artificial intelligence (AI) continues to rise, there is a growing trend of cryptocurrency projects attempting to combine AI with blockchain.

The most representative type of AI-related cryptocurrency project is the decentralized graphics processing unit (GPU) rental project. Decentralized GPUs are a type of decentralized physical infrastructure network (DePIN), which involves uploading unused computing power to the blockchain and renting it out to developers or startups in need of computing power.

EdgeMatrixChain (EMC) is also one of the DePIN projects that provides GPU rental services. However, it is distinguished from other GPU rental DePINs by its ability to offer DeFi and creative platforms using layer 1 blockchain. In August, EMC raised a total of $20 million from venture capital firms such as P2 Ventures and Amber Group for the development of its layer 1 blockchain.

Why are decentralized GPUs needed?

Graphics Processing Unit. /Photo provided by EMC

Decentralized GPU projects have emerged as a solution to the GPU acquisition problem, which is currently the most important issue in the AI industry.

Since the emergence of Open AI's Chat GPT, everyone has jumped into AI development, leading to a surge in GPU demand while supply remains insufficient. As a result, high-performance GPUs used in AI development are currently priced at the level of a car. While big tech companies like Meta and Microsoft have no problem purchasing expensive GPUs, startups and individual developers face financial difficulties.

The demand for GPUs can be seen in NVIDIA's third-quarter report, which virtually monopolizes the GPU market. NVIDIA reported that its third-quarter revenue and net profit surged by 94% and 106% year-on-year, respectively, to $33.16 billion and $19.39 billion, exceeding market expectations.

Decentralized GPU DePINs have become an alternative that can significantly reduce the cost of GPU computing resources, addressing these issues. Binance highlighted in its first-half report this year that "as interest in AI has increased, the cost of computing resources such as GPUs has risen," and "decentralized GPU DePINs have emerged as a cost-effective alternative."

There is also hidden demand for decentralized GPUs from Chinese AI developers sanctioned by the United States. According to the Wall Street Journal, Chinese AI developers have turned to decentralized GPUs as an alternative after being blocked by Amazon Web Services. The media cited EMC as an example, noting that decentralized GPUs, with features such as anonymity through smart contracts, are becoming an attractive option for Chinese AI developers.

EMC, a one-stop platform for AI

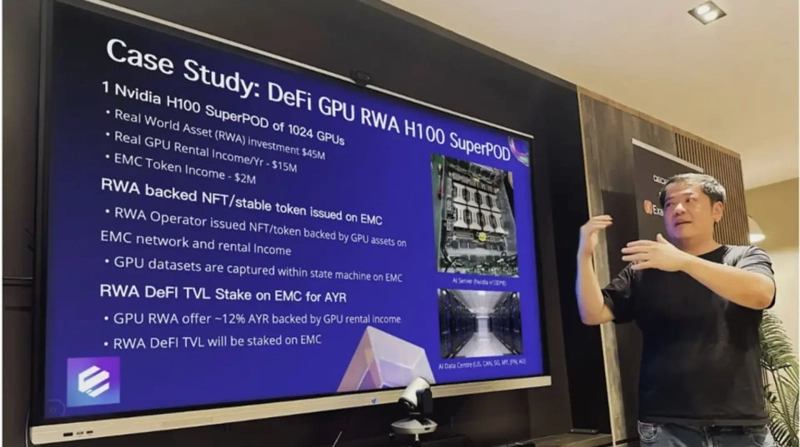

Alex Go, founder of EMC, explaining the NVIDIA H100 cluster SuperPOD at Token 2049. /Photo provided by EMC

As previously explained, EMC is a project that rents out the computing power of GPUs. To this end, EMC currently has 274 nodes on its blockchain and has registered over 3,000 GPUs. The GPUs provided by EMC include NVIDIA A100, GeForce RTX 4090, and GeForce RTX 3090.

Among them, the cluster 'SuperPOD' made by assembling 1,024 'NVIDIA H100' GPUs is considered EMC's strength. Previously, EMC participated in the 'Singapore Token 2049' conference and demonstrated a real-time demo of SuperPOD.

EMC not only rents out GPUs but also provides users with various AI-related services. For example, it offers a platform business that allows users to develop and contentize AI more easily. The EMC AI platform, EMC HUB, includes ▲ AI agent Jarvis Bot that can generate various content, ▲ creative transaction application Omnimuse, and ▲ 3D content creation application Jojo World.

Additionally, EMC helps build networks suitable for AI use. Specifically, it has implemented low latency and high transaction throughput in the network by introducing technologies such as smart routing and data caching. EMC stated, "Our goal is to become a platform that encompasses almost everything in the AI field," and "developers will be able to smoothly test and launch their AI models on the EMC network."

Moreover, EMC is also providing DeFi services using GPUs. Currently, anyone can purchase the computing power of NVIDIA H100 GPUs in the form of tokens within EMC, and by staking them through EMC's DeFi, they can earn an additional income of about 2.7% to 7.1% annually depending on the period. Currently, about 2.6 million EMC tokens are staked in this DeFi service.

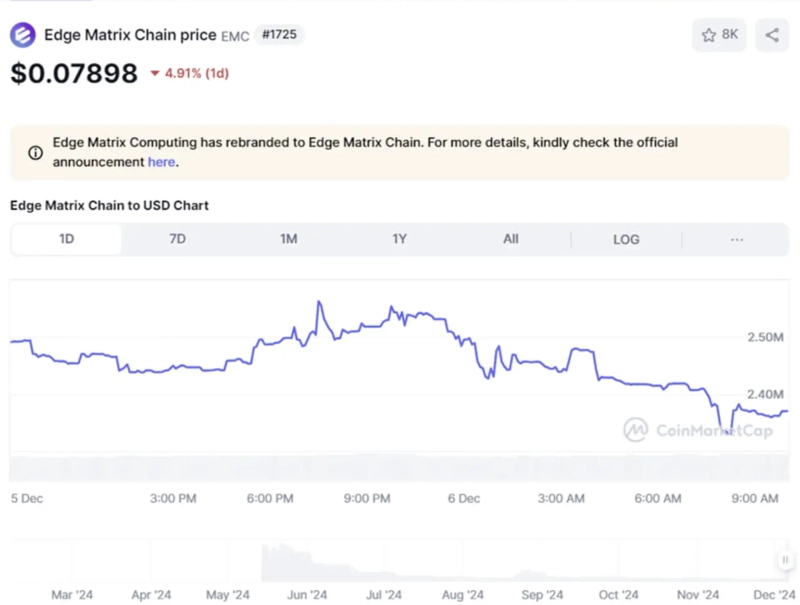

Photo captured from CoinMarketCap

According to CoinMarketCap, EMC tokens are trading at $0.079 as of 10 a.m. on the 6th, down 4.91% from the previous day. The circulating EMC tokens amount to about 30 million, accounting for 3% of the total supply (about 1 billion). The market capitalization is approximately $2.37 million.

Meanwhile, EMC is generating an annual income of about $15 million. Although the business scale is not yet large, the outlook for decentralized GPU projects is generally positive. Data analysis firm Nansen, in a report published with Metastreet, predicted that "considering the DeFi income, tokenomics, and GPU rental revenue of GPU rental services, the total revenue of these services could surge by at least 30% to a maximum of 200%."

Hankyung.com Newsroom open@hankyung.com