Breaking

Breaking News Body Image Attachment Push 003

공유하기

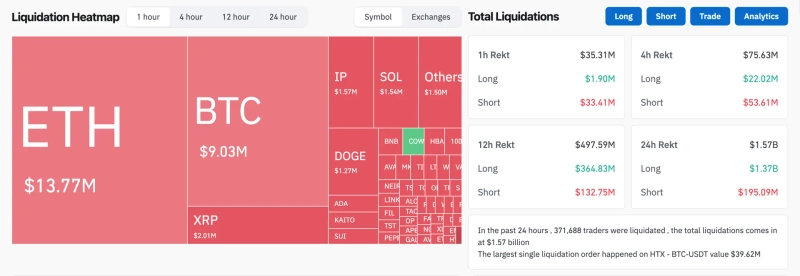

- Reported that a total of $1.5 billion in positions were liquidated in the virtual asset futures market.

- Revealed that Bitcoin spot ETF's net outflow size has reached an all-time high of $773.5 million.

- Reported that the fear and greed index, an investment sentiment indicator, is at 21 points, the lowest level this year.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

Breaking News Body Image Attachment Push 001

The virtual asset (cryptocurrency) market has shown an overall downward trend, resulting in large-scale position liquidations in the futures market.

According to cryptocurrency specialist media BeInCrypto on the 25th (local time), a total of $1.5 billion (approximately 2.15 trillion won) in positions were liquidated in the virtual asset futures market over the past 24 hours.

Looking at liquidation volumes by virtual asset, Ethereum (ETH) had the most with $13.8 million, followed by Bitcoin ($9 million), XRP ($2 million), Story ($1.6 million), and Solana ($1.5 million).

In this situation, indicators for spot ETFs, which represent institutional investors entering the market, are heading toward the worst. According to current figures, Fidelity FBTC saw net outflows of $344.7 million, with large net outflows also recorded from Bitwise BITB, Grayscale BTC, and GBTC. The current net outflow size of Bitcoin spot ETFs is $773.5 million, already recording the largest net outflow ever, even though the net flow indicators for BlackRock IBIT and ARK Invest ARKB have not yet been tallied.

The fear and greed index, which shows investor sentiment in the virtual asset market, recorded 21 points, down 4 points from the previous day, showing the lowest figure this year.

The virtual asset (cryptocurrency) market has shown an overall downward trend, resulting in large-scale position liquidations in the futures market.

According to cryptocurrency specialist media BeInCrypto on the 25th (local time), a total of $1.5 billion (approximately 2.15 trillion won) in positions were liquidated in the virtual asset futures market over the past 24 hours.

Looking at liquidation volumes by virtual asset, Ethereum (ETH) had the most with $13.8 million, followed by Bitcoin ($9 million), XRP ($2 million), Story ($1.6 million), and Solana ($1.5 million).

In this situation, indicators for spot ETFs, which represent institutional investors entering the market, are heading toward the worst. According to current figures, Fidelity FBTC saw net outflows of $344.7 million, with large net outflows also recorded from Bitwise BITB, Grayscale BTC, and GBTC. The current net outflow size of Bitcoin spot ETFs is $773.5 million, already recording the largest net outflow ever, even though the net flow indicators for BlackRock IBIT and ARK Invest ARKB have not yet been tallied.

The fear and greed index, which shows investor sentiment in the virtual asset market, recorded 21 points, down 4 points from the previous day, showing the lowest figure this year.

The virtual asset (cryptocurrency) market has shown an overall downward trend, resulting in large-scale position liquidations in the futures market.

According to cryptocurrency specialist media BeInCrypto on the 25th (local time), a total of $1.5 billion (approximately 2.15 trillion won) in positions were liquidated in the virtual asset futures market over the past 24 hours.

Looking at liquidation volumes by virtual asset, Ethereum (ETH) had the most with $13.8 million, followed by Bitcoin ($9 million), XRP ($2 million), Story ($1.6 million), and Solana ($1.5 million).

In this situation, indicators for spot ETFs, which represent institutional investors entering the market, are heading toward the worst. According to current figures, Fidelity FBTC saw net outflows of $344.7 million, with large net outflows also recorded from Bitwise BITB, Grayscale BTC, and GBTC. The current net outflow size of Bitcoin spot ETFs is $773.5 million, already recording the largest net outflow ever, even though the net flow indicators for BlackRock IBIT and ARK Invest ARKB have not yet been tallied.

The fear and greed index, which shows investor sentiment in the virtual asset market, recorded 21 points, down 4 points from the previous day, showing the lowest figure this year.

![2025-12-24 [Javis] 'PICK News Image5 Reporter Taek'](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)