News with Image 555

공유하기

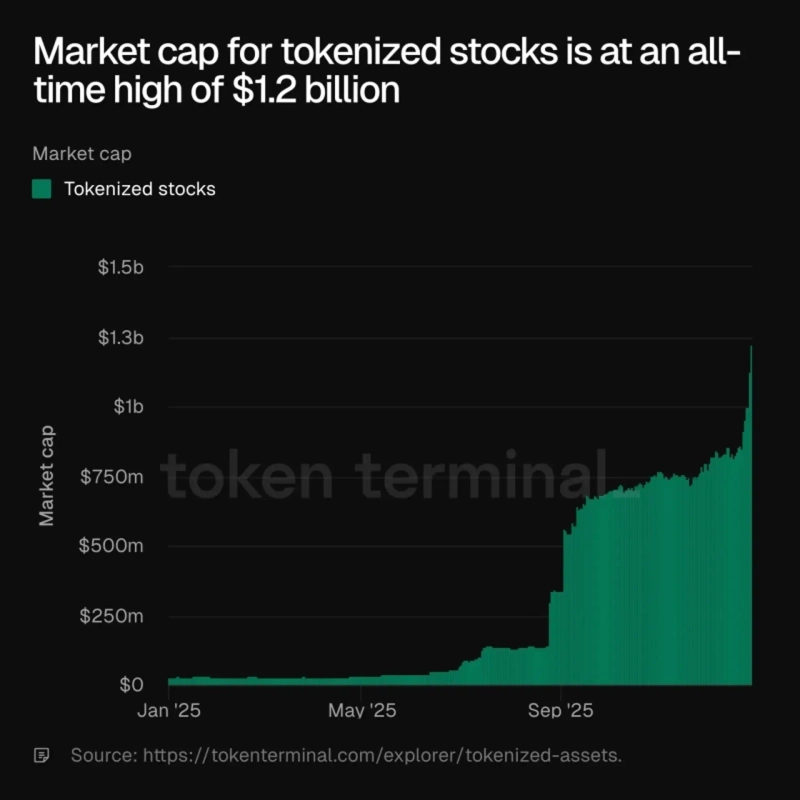

- According to Token Terminal data, the combined market capitalization of tokenized stocks hit a record high of US$1.2 billion.

- It reported that market size expanded significantly, particularly in September and December.

- It said analyses suggest that if global equities move on-chain, improved settlement speed and other structural advantages over traditional financial markets could be highlighted.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Demand for stock tokenization is rapidly expanding and is being seen as an early sign of broader blockchain adoption beyond Bitcoin and stablecoins.

According to Token Terminal data cited by Cointelegraph on the 30th (local time), the combined market capitalization of tokenized stocks reached US$1.2 billion (about 1.7214 trillion won), a record high. In particular, the market size expanded significantly around September and December.

Token Terminal assessed that "the current market for tokenized stocks is at a stage similar to stablecoins in 2020." Stablecoins were still in an early experimental stage in 2020, but subsequently grew rapidly to become a US$300 billion market this year.

Some in the industry compare tokenized stocks to the early days of decentralized finance (DeFi) in 2020. Analysts say that if global equities move on-chain, structural advantages over traditional financial markets could be highlighted, such as improved settlement speed, 24-hour trading, and fractional investing.