Ethereum sees signs of 'bottom-fishing' buying… buy/sell ratio hits highest level in six months

공유하기

Summary

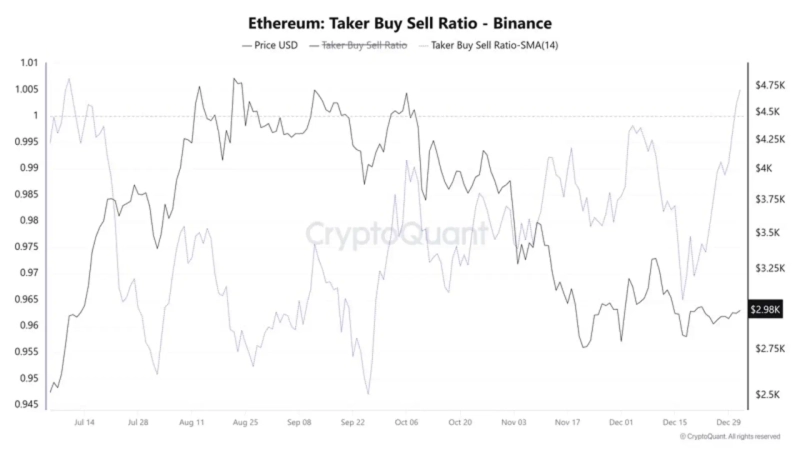

- CryptoQuant said Ethereum’s two-week taker buy/sell ratio on Binance rose to 1.005, the highest level since July last year.

- CryptoQuant explained that a sustained dominance of taker buy orders has historically often served as a leading signal of bullish volatility.

- CryptoQuant added that if the current buy-side dominance persists, it could provide strong support for a price rebound, but said additional indicators are needed to confirm a trend reversal.

In the Ethereum (ETH) market, buying pressure is overpowering selling, signaling a tentative recovery in investor sentiment. The analysis suggests aggressive buying is flowing in at relatively low price levels.

According to data from CryptoQuant on the 1st (local time), Ethereum’s two-week taker (Taker·market-order) buy/sell ratio on Binance climbed to 1.005. That is the highest level since July last year.

A taker buy/sell ratio above 1 means the volume of market-buy orders has outpaced market-sell orders. In other words, it suggests investors are actively accumulating Ethereum at current price levels.

CryptoQuant said, "It is worth noting that this has occurred when Ethereum’s price is relatively low," adding that "historically, a sustained dominance of taker buy orders has often served as a leading signal of bullish volatility." It continued, "If the current buy-side dominance persists, it could provide a strong support base for a price rebound," while adding that "additional indicators need to be checked for a clear trend reversal."

On the day, Ethereum is trading in the $3,000 range on Binance’s Tether (USDT) market, up 0.7% from the previous day.