"It feels like prices are still crushing"…Consumer inflation hits a five-year low—why? [Lee Gwang-sik’s A Bite of Prices]

공유하기

Summary

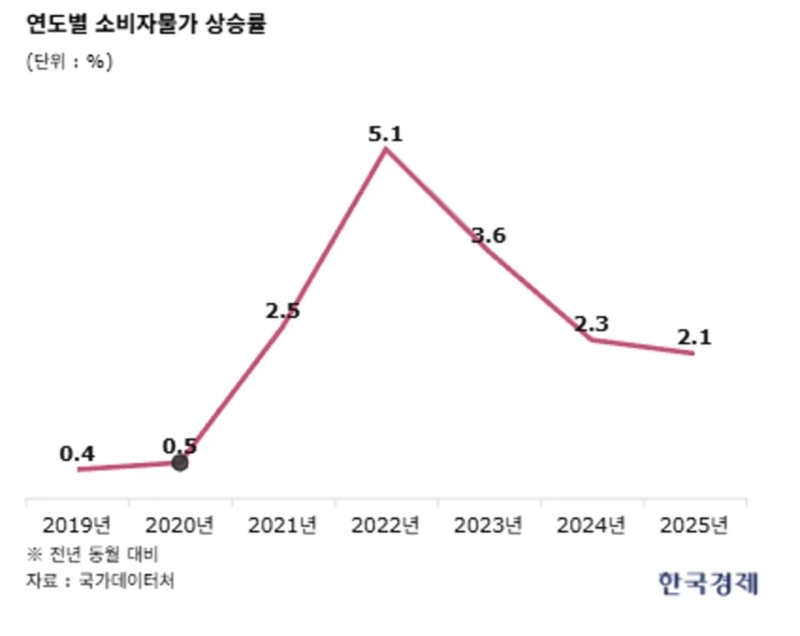

- Last year’s consumer inflation rate was 2.1%, the lowest in five years, but it said felt inflation remained high due to accumulated high prices and a weak won.

- It reported that petroleum products, imported fruit, imported beef and grains rose sharply due to the weak won and factors such as the government’s market withdrawals, increasing the burden across individual items.

- It said this year’s inflation could be influenced by variables including the exchange rate, petroleum products and imported raw material prices, weather conditions, and price swings in agricultural, livestock and seafood products.

High prices have built up, now compounded by the recent rise in the exchange rate

Global crude prices are falling, but domestic fuel prices are rising

Processed food and dining-out prices up nearly 25% over five years

Fruit and vegetable prices fell, but…base effects loom large

This year’s inflation: the exchange rate and weather conditions are key ‘variables’

Last year’s consumer inflation rate was tallied at 2.1%. It is the lowest level in five years since 2020, when COVID-19 took hold in earnest. It is also not far from the authorities’ 2% target. Yet few people felt that “prices were really stable” last year. That is because high prices have accumulated over a long period, and a weak won has also stirred up prices for petroleum products and imported agricultural goods.

The National Data Center released “December 2025 and Full-Year Consumer Price Trends” on Dec. 31, the last day of the year. The consumer inflation rate for December came in at 2.3%. Once again, the key driver was the exchange rate. As petroleum product prices rose 6.1%, they posted the largest increase in 10 months since February last year (6.3%).

Even as global crude prices fall, domestic fuel prices are rising after passing through a “high-exchange-rate filter.” A National Data Center official explained: “Based on Dubai crude, international oil prices edged down from $64.5 per barrel in November last year to an average of $62.1 from Dec. 1 to 24, but over the same period the won–dollar exchange rate rose from 1,457 won to 1,472 won, offsetting the decline.”

Prices of imported fruit such as bananas (6.1%), mangoes (7.1%) and kiwifruit (18.2%) were also not immune to the exchange-rate effect. Imported beef rose 8% as the weak won was compounded by poorer harvest conditions in major supplier countries such as the United States. In addition, prices of mainly domestically produced agricultural items also increased 4.1%, including rice (18.6%), apples (19.6%) and tangerines (15.1%).

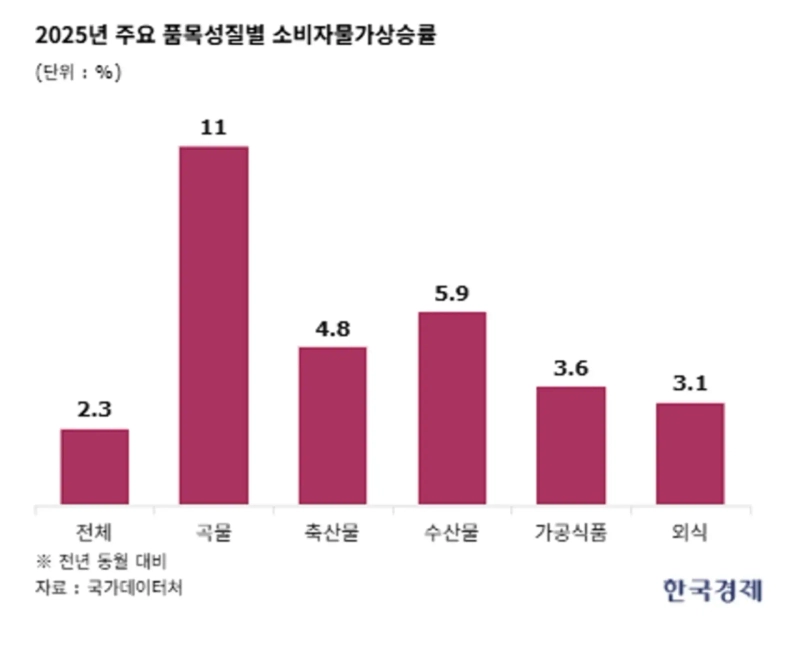

Among agricultural products, grain prices rose 11%, marking the largest increase in seven years since 2018 (21.9%). A major factor was a 7.7% jump in rice prices due to the government’s excessive market withdrawals. The government purchase price for public rice reserves—set based on farmgate rice prices during the harvest season—hit a record high last year at 80,160 won per 40 kg (Grade 1).

Vegetable (-3.4%) and fruit (-1.3%) prices fell year on year, but the view is that this is an optical effect driven by base effects. In 2024, when a heat wave hit, vegetable and fruit prices rose 25% and 16.9%, respectively. Prices of livestock and seafood products also rose 4.8% and 5.9%, respectively, last year—more than double the headline inflation rate.

Processed food prices rose 3.6% last year, while dining-out prices increased 3.1%, with both posting gains in the 3% range. Dining-out inflation has exceeded 3% for four consecutive years since 2022 (7.7%). Processed food and dining out are sensitive price indicators for urban office workers, and they have risen 24–25% over the five years since 2020.

Petroleum products rose 2.4% last year, turning back to an uptrend for the first time in three years since 2022 (22.2%). The National Data Center said: “Separately from the overall price index, there are many individual items where prices have jumped sharply,” adding: “A gap can arise between the official inflation indicators and the inflation consumers feel.”

How will inflation move this year? The authorities again point to the exchange rate as a key variable. A weak won is likely to first feed into prices for petroleum products and imported raw materials, and then spread more broadly to areas such as dining out and processed foods. The Bank of Korea, in last month’s “2026 Monetary and Credit Policy Operating Direction,” projected that a weak won and a recovery in domestic demand could become upside pressures on inflation this year. A Ministry of Economy and Finance official said: “Price fluctuations in agricultural, livestock and seafood products due to geopolitical risks or weather conditions could act as variables.”

Reporter Lee Gwang-sik bumeran@hankyung.com

![2026-01-02 [Jarvis] 'PICK News Image 5 Selection Reporter'](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)