[Analysis] "Bitcoin short-term investors are becoming more sensitive to volatility…lack conviction in their positions"

공유하기

Summary

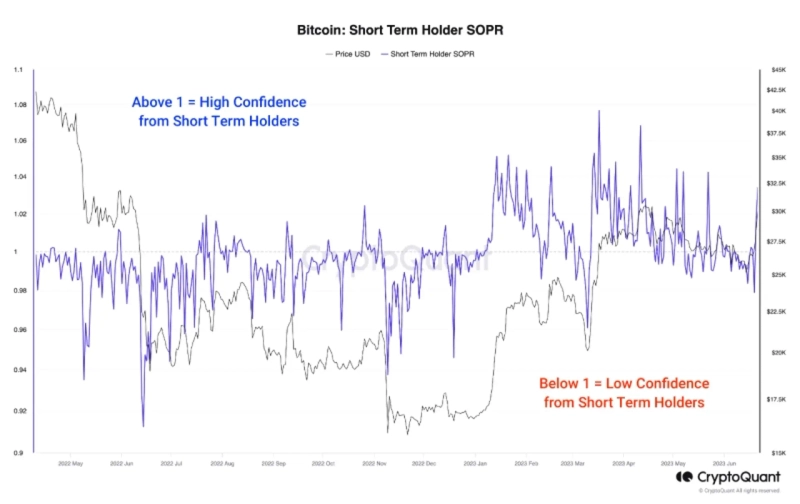

- CryptoZeno said Bitcoin short-term holders’ SOPR is moving sideways around 1.0, indicating market participants’ confidence is extremely fragile.

- He analyzed that because short-term holders’ SOPR has not been able to hold steadily above 1.0, demand is not sufficiently absorbing supply from recent buyers, resulting in a structure that constrains upside momentum.

- He added that the current pattern typically appears in the late stage of a bear market or an early recovery phase, and that if SOPR worsens, the risk of additional rangebound trading or an expansion in downside volatility could increase.

An analysis suggests that Bitcoin (BTC) short-term investors have become more sensitive to price volatility than before.

CryptoZeno, a CryptoQuant contributor, said via CryptoQuant on the 31st (local time) that "Bitcoin short-term holders’ (STH) SOPR (Spent Output Profit Ratio) is moving sideways around 1.0, the key baseline." CryptoZeno explained that "short-term holders’ SOPR is a behavior-based on-chain indicator showing whether they are taking profits or selling while accepting losses," adding that "(the recent SOPR trend) indicates market participants’ confidence is extremely fragile."

CryptoZeno stressed that "throughout the observation period, short-term holders’ SOPR failed to sustain a meaningful breakout above 1.0." He continued, "There were instances where it temporarily entered a profit-taking zone, but the pattern repeatedly reverted quickly to neutral or loss-realization territory," adding that "this means (Bitcoin) short-term holders are reacting extremely sensitively to price fluctuations and lack the conviction to maintain positions through volatility."

The analysis also said upside momentum in the SOPR indicator has been limited. CryptoZeno noted, "The fact that short-term holders’ SOPR has not been able to hold steadily above 1.0 means current demand is not sufficiently absorbing supply from recent buyers who entered near the top," adding that "as a result, attempts at (price) gains continue to run into overhead resistance, keeping momentum expansion constrained."

He also suggested the current phase could be in the late stage of a bear market. CryptoZeno said, "Periods when short-term holders’ SOPR clearly fell below 1.0 appeared closely intertwined with sharp price corrections," analyzing that "this indicates selling pressure was dominated by stress-driven selling rather than strategic selling." He added, "Such patterns generally emerge in the late stages of a bear market or in the early recovery phase," and said, "During such periods, investors tend to prioritize capital preservation over trend-following."

He also mentioned the possibility of additional downside. CryptoZeno analyzed, "Until conditions are in place for short-term holders to realize profits stably without immediate selling, the Bitcoin market is likely to remain structurally fragile," adding that "if (SOPR) deteriorates, the risk of further rangebound trading or an expansion in downside volatility could increase."

![2026-01-02 [Jarvis] 'PICK News Image 5 Selection Reporter'](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)