[Analysis] “Bitcoin stuck in a ‘high-volatility range’…lacking structural momentum”

공유하기

Summary

- XWIN Research Japan said Bitcoin remains in a high-volatility range, with insufficient confirmation of structural momentum, describing the market as conditionally neutral or a weak bear phase.

- XWIN Research Japan noted that broader ETF adoption and supply constraints are long-term support factors, but macroeconomic uncertainty, the U.S. midterm elections, and derivatives-led price discovery are limiting directionality.

- XWIN Research Japan said Bitcoin could trade in the $80,000–$140,000 range, with a key trading zone of $90,000–$120,000; in a recession it could fall to the $50,000 range, while stable ETF inflows could lift it to $120,000–$170,000.

An analysis suggests that Bitcoin (BTC) prices are likely to continue moving sideways within a range this year as well.

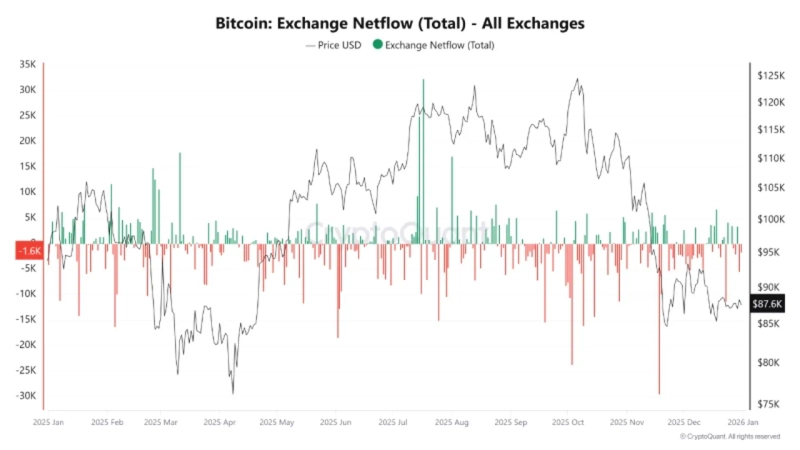

A CryptoQuant contributor from XWIN Research Japan said on the 1st (local time) via CryptoQuant that “as 2026 begins, it is still difficult to say that Bitcoin has clearly entered a new bull phase,” adding that “the market remains in a ‘high-volatility’ range.” XWIN Research Japan noted that “broader adoption of exchange-traded funds (ETFs) and supply constraints are acting as long-term support factors,” but also said that “macroeconomic uncertainty, political variables surrounding the U.S. midterm elections, and the ongoing derivatives-led price discovery are continuously limiting (Bitcoin’s) directional move.”

XWIN Research Japan forecast that Bitcoin prices are likely to follow a “Twisted Range” pattern this year. He said that “at this point, (the market) is conditionally neutral or a weak bear market,” adding that “there is still a lack of structural confirmation to underpin strong upside momentum.”

He continued, “Expectations for rate cuts persist, but a recovery in the real economy has not fully taken hold, and capital inflows are being driven by short-term ETF flows,” pointing out that “in this case, Bitcoin is likely to move within a wide range of $80,000 to $140,000.” He added that “the $90,000 to $120,000 zone is likely to become the key trading area.”

He also mentioned the possibility of falling below $80,000. XWIN Research Japan analyzed that “if recession risks increase, deleveraging and ETF outflows could coincide and push Bitcoin below $80,000,” adding that “in an extreme case, the possibility of a decline into the $50,000 range cannot be ruled out.” He also said that “if ETF inflows and other factors stabilize, Bitcoin could extend gains into the $120,000 to $170,000 range,” but added that “prices beyond that would be possible only if multiple favorable conditions are met simultaneously.”

![2026-01-02 [Jarvis] 'PICK News Image 5 Selection Reporter'](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)