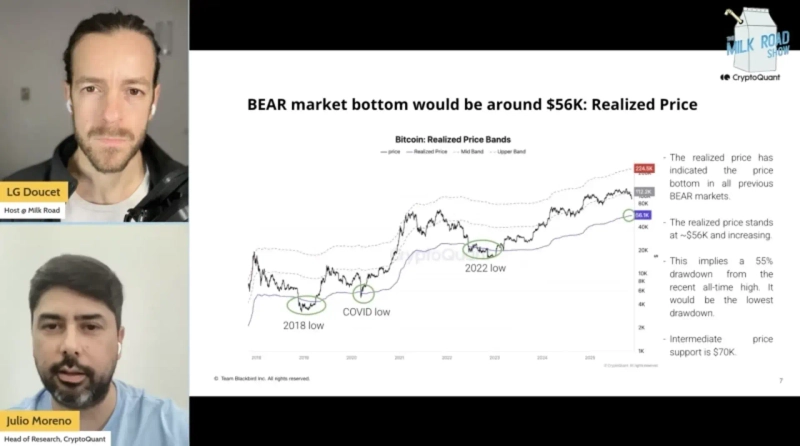

"Bitcoin Has Already Entered a Bear Market…Bottom Seen at $56,000"

공유하기

Summary

- Julio Moreno said Bitcoin has already entered a bear market after falling below its 1-year moving average.

- Moreno put the bottom of this bear market at $56,000–$60,000, estimating the range based on the realized price.

- He said institutional flows via spot ETFs and structural demand are reducing market volatility, improving the market’s structural health compared with the past.

Analysis has emerged suggesting that Bitcoin entered a bearish phase as early as two months ago.

On the 1st (local time), Julio Moreno, head of research at CryptoQuant, appeared on the YouTube channel 'Milk Road' and said, "The Bitcoin price has fallen below its 1-year moving average (the 12-month average price)," adding that "this is a technical indicator confirming entry into a bear market."

He also explained, "Our in-house 'bull market score indicator,' which aggregates network activity, investor profitability, liquidity and other factors, has already turned bearish since early November last year and has yet to recover."

In fact, Bitcoin hit an all-time high of $126,199 on Oct. last year, but later gave back its gains and ended the year below its opening price at the start of the year ($93,576). As of today, Bitcoin is trading around $88,700.

Moreno put the bottom of this bear market in the $56,000 to $60,000 range. This estimate is based on the 'realized price (the average cost basis of all Bitcoin holders).' "Looking at past cases, in a bear market prices tend to fall back toward the realized price level," he said, adding that "this would represent a drop of about 55% from the peak, which shows relatively solid downside resilience compared with past downturns when prices plunged 70–80%."

That said, he assessed that the market’s structural health has improved compared with the past. Unlike the major systemic risks seen in 2022 such as the Terra-Luna collapse or FTX bankruptcy, institutional funds flowing through spot exchange-traded funds (ETFs) are supporting the market.

"In previous bear markets, demand contracted sharply, but now there is structural demand from institutions and ETFs that buy on a regular basis," Moreno added. "They are absorbing supply and reducing market volatility."

![2026-01-02 [Jarvis] 'PICK News Image 5 Selection Reporter'](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)