[Contributed] The Common Language of the Autonomous Economy: Stablecoins in the AI Era and Korea’s Strategic Choice

공유하기

Summary

- Amid a global race for dominance over stablecoins, public blockchains, and AI economic infrastructure, the piece argues that Korea is falling behind due to the absence of a legal definition and restrictive regulation.

- The author says Korea must build KAP (Korean Autonomous Protocol)—an open, won-denominated stablecoin and trust infrastructure interoperable across multiple chains—to secure sovereignty in the digital-economy era.

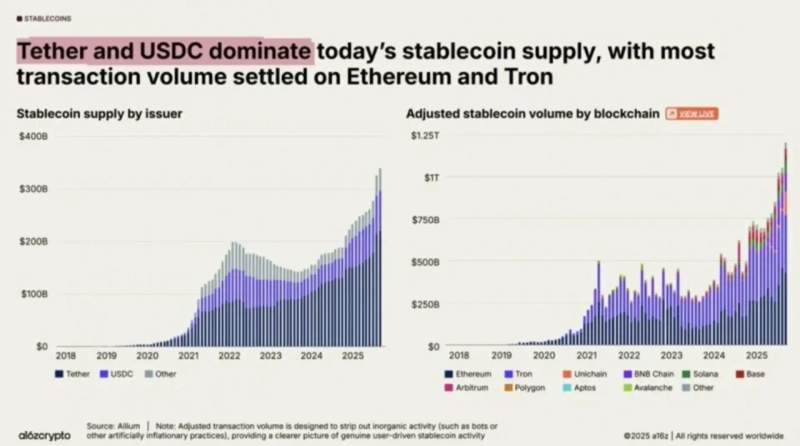

- With global stablecoin markets such as USDC, Tether, and DCJPY growing rapidly, it warns that unless Korea overhauls its framework and moves with the private sector now, it will remain a permanent periphery in digital finance.

Kim Seo-jun, CEO of Hashed

Today’s debate and concerns surrounding stablecoins recall the mid-1990s, when the internet first emerged. Back then, many people regarded the internet as merely an “e-mail system” or a “digital library.” They thought it was no more than a digital version of existing systems. But the internet was a revolution that went beyond being a tool for transmitting information—it changed the operating system of human civilization.

How people view stablecoins today is similar. Many understand them as little more than a “digital won.” They dismiss them as a faster, more convenient remittance tool—simply putting existing money on a blockchain. But that is a misconception that misses the essence of stablecoins. Stablecoins are the common language of an autonomous economy in which AI and humans coexist, and they are core infrastructure for the coming civilizational transition. Based on this perspective, this article discusses changes in economic actors, the limitations of traditional finance, the evolution of technical standards, global competition, and Korea’s strategic choices.

A fundamental shift in economic actors and the need for digital infrastructure

As of 2025, we stand at the most radical inflection point in economic history—because, for the first time, non-human entities are emerging as independent economic actors. To grasp this, consider a simple analogy. In the past, only humans could take a taxi to a destination. But now autonomous vehicles go to a gas station to refuel on their own, get washed at a car wash, and pay tolls. The vehicle has become an “economic actor.”

OpenAI’s ChatGPT generated $2.7 billion in annual revenue in 2024, handling more than 1 billion conversations a day. This is not merely a tool doing work. It is AI providing services on its own and getting paid—in other words, engaging in economic activity. Tesla’s autonomous-driving AI collects and sells real-time driving data, contributing a significant portion of the company’s $97 billion in 2024 automotive revenue. DeepMind’s AlphaFold sells access to databases essential to drug discovery through protein-structure prediction. Just as a doctor charges consultation fees, AI is being compensated for its specialized knowledge.

The common problem these AI systems face is how to exchange economic value. Traditional banking systems were designed around humans. Identity verification, signatures, and decision-making all assume a human. Imagine an AI at a bank counter saying, “Hello, I’m ChatGPT. I’d like to open an account.” Under today’s system, that is impossible. AI cannot hold a passport, cannot go to a bank counter, and cannot sign documents.

This limitation is not merely a technical issue. According to a recent McKinsey report, by 2030 as much as 30% of total working hours could be automated by AI. This is not simply about efficiency. It is a civilizational shift that requires a fundamental redesign of the economic system. Just as money evolved from shells to metal coins, to paper currency, and then to credit cards as society moved from agrarian to industrial, the AI era demands a new mechanism for value exchange.

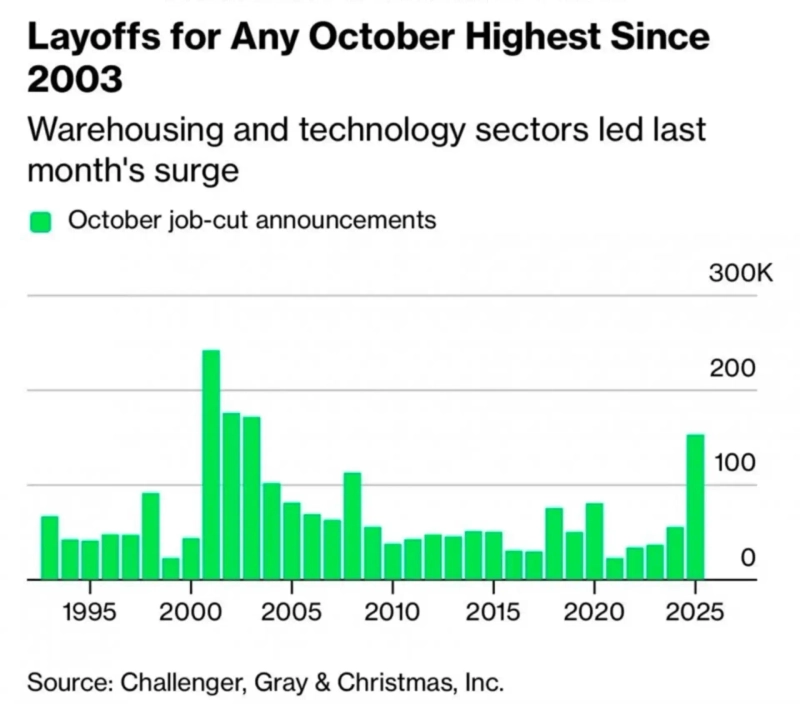

In fact, the U.S. labor market in October 2025 vividly illustrates this trend. Layoffs reached 153,000, the largest since 2003, while UPS announced record profits even as it cut 34,000 jobs—sending its shares up 12%. It is akin to the moment tractors were introduced in an agricultural society, allowing a single machine to replace the work of hundreds of farmers. Markets reward efficiency gains, not labor preservation, and interpret layoffs as a signal of value creation. AI and automation raise productivity, but the gains do not flow back to workers; they shift the system’s value framework.

Structural limits of traditional finance and the need for public infrastructure

Traditional financial systems have fundamental limitations that prevent them from absorbing these changes. First, they are centralized. Every transaction must pass through a bank—like a “traffic light.” If the bank closes, transactions stop, and crossing borders requires complex procedures. By contrast, AI runs 24/7, does not recognize borders, and transacts in microseconds. It is an inefficiency akin to a car that never stops having to wait for a traffic light to change.

Second, there is the problem of identity verification. KYC (Know Your Customer) and AML (Anti-Money Laundering) rules presume humans. It is like requiring an eye test and written exam to issue a driver’s license—standards that cannot be applied to AI. How do we verify an AI’s “identity”? If an AI commits a crime, who goes to prison? The current system cannot answer these questions.

Third, there are limits to measuring value. Traditional finance was designed around tangible assets such as factories, land, and buildings. Yet in 2024, 90% of S&P 500 company value was intangible assets; in 1975, it was only 17%. It is as if society suddenly moved from an era of weighing physical goods on a scale to one in which it must measure the value of ideas or brands. Netflix’s value lies not in DVD warehouses but in its recommendation algorithms, and Google’s value lies not in servers but in search technology.

Moreover, new assets are emerging that require real-time measurement and immediate settlement, such as carbon credits. It is like measuring and trading air quality in real time. PwC projects the carbon market will reach $250 billion by 2030. How will copyrights for AI-generated content be traded? What is the value of health data produced by individuals? What about the right to use one second of computing power? Traditional finance lacks even the language to express these. As with the transition from DOS to Windows, the evolution from simple command processing to complex multitasking and object-oriented systems goes beyond the limits of imagination. That Netflix can process tens of millions of data points simultaneously to deliver personalized recommendations was inconceivable in the DOS era.

Convergence of technical standards: protocols for digital civilization

To overcome these constraints, new technical standards are advancing rapidly. Among them, the x402 protocol announced by Coinbase last May is an intriguing experiment. It is still early-stage, but noteworthy as an attempt to enable autonomous economic activity by AI agents. The protocol extends the HTTP 402 (Payment Required) status code to explore a standardized way for AI to execute payments directly on the web. If the existing 402 code merely conveyed the message “payment required,” x402 points toward a direction in which AI can pay immediately and use services.

The significance of x402 lies less in its technical completeness than in the vision it presents. Imagine a future in which AI can make “economic judgments.” For example, when an AI research agent searches for academic papers and needs access to a paid journal, it could use such a protocol to instantly calculate value relative to cost and automatically pay the subscription fee. This could be a first step toward granting AI a level of autonomy akin to a human researcher deciding, “Do I need this paper for my work?”

If this vision becomes reality, what would it look like? When AI journalists write articles while accessing data sources in real time, they could automatically reach Bloomberg or Reuters paid data via protocols like x402. Even more interesting is the possibility that such AI could acquire “budget management” capabilities. They might set a monthly budget, prioritize spending by importance, and switch to free sources when budgets run short.

Further, one can imagine the formation of an economic ecosystem among AIs. A translation AI pays to access a specialized terminology database, and the AI managing that database uses the revenue to collect more data—a virtuous cycle. In other words, an autonomous economy could emerge in which AIs provide services to one another and get paid.

In healthcare, particularly transformative possibilities could open up. When an AI diagnostic support system identifies rare diseases, one could envision a future in which it instantly accesses specialized medical databases worldwide via protocols like x402. The more complex a patient’s symptoms, the more data sources it accesses, evaluating each source’s reliability and cost in real time to produce an optimal diagnosis. The entire process happens within seconds, with costs settled automatically.

Ultimately, what Coinbase’s x402 experiment aims for is to build an “operating system for the AI economy.” It is still early, but it explores the possibility that AI can evolve into fully autonomous economic actors that generate revenue, purchase needed resources, and collaborate with other AIs. If this succeeds, we will truly enter the era of an autonomous economy. The x402 standard has drawn explosive interest from developers and is spawning diverse ecosystems; since last October it has processed 15 million AI-to-AI payments, with transaction volume reaching $10 million.

Of course, experimental protocols like x402 alone are not enough. For AI’s economic activity to become fully autonomous, it needs a reliable store of value and transaction infrastructure. Here, blockchain technology plays a pivotal role. The evolution of blockchains is particularly noteworthy. When ERC-4337 (Account Abstraction), which has taken root as a standard across various ecosystems including Ethereum, is combined with AI agents, it allows AI agents to hold independent wallets and program complex payment conditions. Put simply, it gives AI an “allowance management capability.” In a joint prototype by Google and Visa, the AI set and executed rules on its own: “I can spend up to 1 million won per month, transact only with verified merchants, and if there is a problem with the goods, automatically request a refund.”

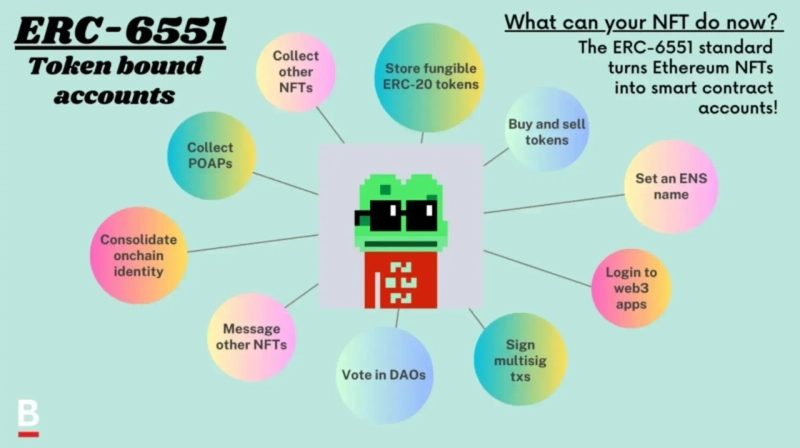

ERC-6551 is even more innovative. This standard enables each digital asset to have its own wallet. For example, a digital artwork could manage its own revenue, collect exhibition fees, and pay insurance premiums. Yuga Labs’ Bored Ape NFT already manages licensing revenue through its own wallet—like the magical world of Harry Potter, where artwork comes alive and manages itself, made real.

The International Organization for Standardization (ISO) has also joined the shift. ISO 24165 provides a standard for digital token identification, while ISO 20022 is becoming a foundation for financial message exchanges between AI systems. The Swiss National Bank and the BIS are running digital currency experiments using these standards. Traditional financial institutions, too, are beginning to recognize the need to build infrastructure suited to the AI-economy era.

This progress in technical standards is not merely technological innovation. It is igniting a new form of competition among nations—because preempting technical standards and building economic ecosystems on top of them will determine hegemony in the future economy.

Global competition: hegemony over digital infrastructure

Major economies are recognizing stablecoins as the core of next-generation economic infrastructure. It resembles the 19th-century competition over who would build railway networks first. Just as the countries that laid railroads first led the Industrial Revolution, the countries that lay the digital economy’s railroads first will lead the future.

The United States is building digital-dollar hegemony through Circle’s USDC. In 2025, USDC’s market capitalization is $75.2 billion, comparable to the GDP of a mid-sized country. Monthly transaction volume exceeds $5 trillion, accounting for a substantial share of global trade. It is like a digital version of the Bretton Woods system, in which the dollar became the world’s key currency after breaking from the gold standard.

The European Union is writing the “rules of the game” through MiCA regulation. More than 20 euro stablecoins compete within those rules. The European Central Bank is reviewing a digital euro in stablecoin form. Just as the EU created a global standard for data protection through GDPR, it is attempting to set the standard for digital money.

Japan’s approach is even more sophisticated. DCJPY, built jointly by MUFG, SMBC, and Mizuho, is not merely a digital yen. It is “programmable money”—money that thinks and acts. Just as smartphones evolved beyond simple phones into computers, money too is evolving beyond a mere store of value into a computer that executes smart contracts.

Singapore’s Project Guardian shows theory becoming reality. Led by the Monetary Authority of Singapore (MAS) with participants including JPMorgan, DBS, and SBI Digital, it is an asset-tokenization pilot that tested new ways to trade and settle real-world assets such as government bonds, FX, and funds on blockchain. In particular, the carbon-credit trading system implemented in the project cut transaction costs by 92% and shortened settlement from days to instant. This is like the revolution that occurred when letters became e-mail—not just a speed improvement, but the birth of an entirely new market.

Korea’s strategic choice: designing the digital arteries

As all this global competition unfolds, where does Korea stand? Unfortunately, we are already far behind. Korea still lacks even a legal definition of stablecoins. Private issuance of won-denominated stablecoins is effectively prohibited, and relevant bills are merely pending in the National Assembly.

Korea is one of the rare countries that built its own internet ecosystem outside the dominance of global Big Tech. Naver leading search, Kakao leading messaging, and NCSoft leading games is highly unusual in a world where Google and Meta dominate globally. This was possible because Korean founders were able to experiment freely during the internet’s formative years in the 1990s and early 2000s. At the very time Google and Yahoo were being born in Silicon Valley, innovation erupted simultaneously in Korea—producing competitive “homegrown platforms” to the point that Google once considered acquiring Naver.

But the opposite is happening in the ongoing digital-finance revolution. As the U.S. effectively monopolizes the stablecoin market and sets global standards, Korean founders cannot even experiment due to unclear regulation. Whether Korea—once able to “start at the same time” in the internet era—can seize the opportunity again in the blockchain-finance era will be a watershed for digital sovereignty. Due to network effects, stablecoins and blockchains become exponentially more valuable as user numbers grow.

Yet crisis is opportunity. Korea’s success story has always begun with challenges that seemed impossible. Just as it rose from one of the world’s poorest countries in the 1960s to become a semiconductor powerhouse, and just as it turned the IMF crisis of the 1990s into an opportunity for digital innovation, we can do it again. Latecomer advantages allow us to avoid past mistakes and design better systems. What matters is that we can no longer afford to waste time.

Korea already has strong foundations. Above all, it has world-class software development capabilities. Korean developers already play key roles in global open-source projects and are deeply involved in major blockchain ecosystems such as Ethereum, Cosmos, and Polkadot. On algorithm platforms like LeetCode, Korean developers rank among the world’s best, and in GitHub contributions they are among the top in Asia.

Even more important is Korean developers’ execution and completeness. Just as KakaoTalk built an independent ecosystem while competing with global messengers, Korean developers rapidly absorb global standards, localize them, and go further by adding innovative features. The fact that exchanges such as Upbit and Bithumb rank among the global top tier, and that Korean developers act as core contributors across numerous DeFi protocols, proves this.

Samsung has already embedded a blockchain wallet into smartphones, and LG has developed a blockchain-based identity authentication system. This demonstrates Korea’s distinctive strength in combining hardware and software. Just as it has vertically integrated capabilities from semiconductor design to system integration, it can build full-stack capabilities in blockchain infrastructure as well.

Korean Autonomous Protocol (KAP)

The Korean-style blockchain network we must build—Korean Autonomous Protocol (KAP)—should not be merely a won stablecoin. It must be a comprehensive trust system operating on public blockchains. It is a strategic tool for Korea to secure sovereignty in the digital-economy era and, furthermore, to lead global standards.

KAP’s design principles are clear. First, interoperability. Korea’s stablecoin must operate across major public blockchains such as Ethereum, Polygon, and Solana. It is like Korea’s 5G technology being compatible with global standards. An isolated system, no matter how strong, cannot survive global competition.

Second, openness. The core of public blockchains is that anyone can participate. KAP must be a public good that all developers and companies can use—not a monopoly of a particular company or institution. It is like Hangul being an asset of all Koreans, not the property of any one person.

Third, innovation. Rather than merely replicating existing systems, it must provide new functions suited to the AI era. For example, it could embed mechanisms to monitor AI behavior in real time, automatically block anomalous transactions, and ensure fair revenue distribution.

Consider specific use cases. If a K-content creator mints a work as an NFT, fans worldwide can purchase it with stablecoins, and revenue is distributed automatically via smart contracts. The entire process proceeds transparently on public blockchains and can be verified by anyone. If Korean SMEs record supply-chain data on blockchain, AI can analyze it to propose optimization measures and receive rewards based on improved efficiency. Individuals’ health data can be encrypted and stored on blockchain, with automatic compensation paid each time research institutions use it.

All of this is possible because public blockchains are the digital arteries. And stablecoins are the lifeblood of value flowing through those arteries.

A new governance of trust: transparency and decentralization

The greatest strengths of public blockchains are transparency and decentralization. But they also introduce new challenges.

Transparency means all transactions are public. It is a powerful tool to prevent corruption and manipulation, but it also raises privacy issues. How will KAP strike this balance? Using cryptographic techniques such as Zero-Knowledge Proofs, it can prove transaction validity while protecting details. It is like verifying the legitimacy of an election while guaranteeing a secret ballot.

Decentralization means there is no single point of failure. In traditional systems, if a central server goes down, everything is paralyzed. But because tens of thousands of nodes operate simultaneously in public blockchains, the whole system continues even if some fail. It follows the same principle as the internet being designed to survive nuclear war.

However, decentralization increases governance complexity. Who makes decisions, and how? KAP should enable stakeholders to participate democratically through a DAO (Decentralized Autonomous Organization) structure. Citizens (stablecoin users), companies, and government agencies should all participate in governance, with a structure allowing proposals to be submitted and voted on.

More important is a mechanism to protect human dignity. When AI causes mass unemployment, public blockchains can be a tool to distribute the gains from automation fairly. If a company achieves productivity gains from AI, a portion of that benefit could automatically be transferred to a social fund through a “smart tax” system. This is a social contract written in code.

At a crossroads for digital financial sovereignty

We are now at an inflection point of a digital renaissance. Just as the 15th-century Renaissance was triggered by the convergence of printing technology and banking systems, the 21st-century digital renaissance is unfolding through the convergence of public blockchains and stablecoins. Public blockchains are not merely technical innovation; they are foundational infrastructure for a new civilization. If the Roman Empire built physical connectivity through roads, digital civilization is building connectivity of value through a trust network called blockchain.

Korea’s technological capabilities are already proven. Global leadership in semiconductors, pioneering deployment of ultra-fast internet infrastructure, and the global spread of cultural content demonstrate our potential. But in the competition over digital financial infrastructure, a different dynamic is playing out. Unlike semiconductors or telecommunications infrastructure, blockchains and stablecoins are domains dominated by network effects. In market structures where first-mover advantage is maximized, it becomes exponentially harder for latecomers to catch up.

Empirical data supports this. USDC grew from $1 billion in 2020 to $75.2 billion in 2025, posting a 134% CAGR. Tether’s market capitalization has surpassed $140 billion and is expected soon to exceed Korea’s holdings of U.S. Treasuries. Japan’s DCJPY is building infrastructure targeting transaction volume of 100 trillion yen, and Singapore’s stablecoin payment volume has exceeded $1 billion per quarter. The fees and financial data generated by $5 trillion in daily global stablecoin volume—and the resulting financial hegemony—are already concentrating in specific countries and companies.

In the Age of Exploration, port cities rose; in the 20th century, city-states such as Singapore and Hong Kong emerged as global financial hubs by touting low corporate taxes and flexible regulation. Now it is the era of digital finance led by blockchains and stablecoins. Korea already has all the necessary conditions: world-class technology, consumers quick to adopt new services, and robust digital infrastructure. But without institutional support, the opportunity will vanish. If we do not move now, Korea will remain a permanent periphery in the global digital economy. It is time for government and the private sector to take on the challenge together. Stablecoins and public blockchains are not merely technology; they are core infrastructure that will determine economic sovereignty in the AI era.

The choices we make now will determine Korea’s digital-economic standing for decades to come. There is no time left to hesitate.

■Profile of Kim Seo-jun, CEO of Hashed

△Early graduation from Seoul Science High School

△Graduated from POSTECH (Pohang University of Science and Technology), Department of Computer Science and Engineering

△Co-founder and Chief Product Officer (CPO) at Nori

△CEO of Hashed

△Venture Partner at SoftBank Ventures Asia

△Adviser to the National Assembly Special Committee on the Fourth Industrial Revolution

△Member of the Ministry of Education Future Education Committee

The views expressed in external contributors’ columns may differ from the editorial direction of this publication.