Bitcoin Is Said to Be Rising

Summary

- Experts said Bitcoin could extend its uptrend if it breaks above $31,200 and $32,000, but downside pressure could increase if it falls below the $30,000 level.

- Tina Teng of CMC Markets and Katie Stockton said Bitcoin could rise to $35,000 and $35,900 if it maintains upward momentum, but warned about the $25,200 support level and the possibility of a short-term reversal.

- Connor Ryder said Bitcoin liquidity has fallen to about half since the FTX bankruptcy, increasing volatility and the risk of sharp downside moves, and urged investors to pay attention to risk management.

Bitcoin tops $30,000 on signs of easing US inflation

Emerges as a 'safe haven' after the banking crisis…new investors increase

"Short-term volatility may intensify…next resistance at $31,200"

As signs have emerged that US inflation is easing, Bitcoin (BTC) has broken through the $30,000 (39.35 million won) barrier and is showing strength. With Bitcoin surging more than 80% this year to become one of the best-performing assets, attention is focused on whether it can sustain the uptrend.

As of 4:30 p.m. on the 14th, Bitcoin was trading in Upbit’s KRW market at 40.24 million won, up 0.75% from 24 hours earlier ($30,939 on Binance’s USDT market). At the same time, the “kimchi premium” (the price gap between overseas and domestic exchanges) stood at 0.76%.

Experts said Bitcoin could extend gains if it breaks above $31,200 decisively, but selling pressure could build again if it slips back below $30,000.

Expectations that US rate hikes are nearing the end…possibility of cuts after May

Bitcoin’s recent surge is seen as driven by rising expectations that the Federal Reserve’s rate-hike cycle may be nearing its end as US inflation cools and the labor market shows signs of easing.

On April 12 (local time), the US Labor Department said March CPI rose 5.0% year on year, the lowest since May 2021. Earlier, US March nonfarm payrolls data released on April 7 also came in below market expectations.

US President Joe Biden said in a statement on April 12 (local time) that “this report shows progress in the fight against inflation.” Biden added that “inflation remains too high,” but said “today’s progress means hardworking Americans can have higher wages and more breathing room than they did nine months ago.”

CNBC reported on April 12 that “the March consumer price report could influence the Federal Reserve’s rate decision in May,” adding that “fallout from turmoil that has rocked the banking sector recently could bolster arguments that the Fed should pause rate hikes.”

Bloomberg reported that “US rate-futures markets expect the Fed to raise rates by 0.25% point in May, with cuts expected thereafter.” The New York Times also said “the banking industry is increasingly leaning toward the view that the Fed will soon halt rate hikes.”

Barron’s said on April 13 that “markets are increasingly betting the Fed’s rate hikes are close to ending,” adding that expectations are spreading that “the value of ‘risk assets’ such as digital assets (cryptocurrencies) and tech stocks will rise.”

Meanwhile, some argue that conditions are not yet sufficient for the Fed to pause future hikes and that policymakers may instead have to worry about both inflation pressure and recession risks. Minutes from the Federal Open Market Committee (FOMC) meeting in March, released by the Fed on April 12 (local time), showed officials were concerned the US economy could slip into a mild recession in the second half of the year.

Fed economists projected that “fallout from stress in the US banking sector could push the economy into a ‘mild recession’ starting in the second half, with an exit possible two years later.” Officials said “the recent banking episode could weigh on households, businesses, economic activity and employment, and inflation,” adding that “it is uncertain how far the effects will extend.”

Thomas Barkin, president of the Federal Reserve Bank of Richmond, said in a CNBC interview on April 13 that “inflation has peaked, but we have a long way to go to get it to a controllable range. Core inflation is still too high.” Mary Daly, president of the San Francisco Fed, also said “a strong economy and high inflation suggest there is more work to do,” while noting “how much needs to be done depends on a considerable set of uncertainties.”

According to the CME FedWatch Tool that day, the probability of a rate hike at the May FOMC was still seen at 66.2%, while the probability of a hold was 33.8%.

Bitcoin emerges as an asset 'safe haven' after the US banking crisis

Some analysts also say Bitcoin has emerged as a new haven for storing assets safely following the recent US banking turmoil. The Wall Street Journal said on April 11 that “preference for digital assets has increased since the recent US banking crisis,” adding that “investors see crypto assets as an alternative to the traditional banking system.”

Richard Mico, CEO of payment-infrastructure provider Baanx, said that since the recent banking turmoil (including the collapse of Silicon Valley Bank), Bitcoin has begun to be recognized as a reliable store of value. He added that liquidity is expected to flow further into the (crypto-asset) market.

Bob Ras, co-founder of SoloGenic, a blockchain-based tokenization platform for securities, also said “Bitcoin is emerging as a new asset haven amid financial instability,” adding that a “decoupling” is appearing as Bitcoin does not move in lockstep with equity-market trends and that its appeal as a haven is growing.

Recent rally draws more new investors…will it end the 'crypto winter'?

Some analyses say retail investors have been driving Bitcoin’s recent rally. Mike Novogratz, CEO of Galaxy Digital, said in a CNBC interview on April 11 (local time) that “retail investors have joined in and fueled Bitcoin’s rally,” adding that amid “FOMO (fear of missing out),” Bitcoin prices began to surge as well. He said Bitcoin would “see a new all-time high within two years.”

Crypto data analytics firm Messari said in a recent research report that “the number of wallets holding small amounts of Bitcoin has increased by more than 3% compared with the start of the year.” It said the number of retail wallets has grown relatively more than whale wallets this year, emphasizing that many small investors appear to be stoking the price rise.

Alex Adelman, co-founder of Bitcoin rewards app Lolli, said “Bitcoin is ending the crypto winter and entering a new bull phase,” adding that it is drawing interest not only from retail investors but also from institutional investors.

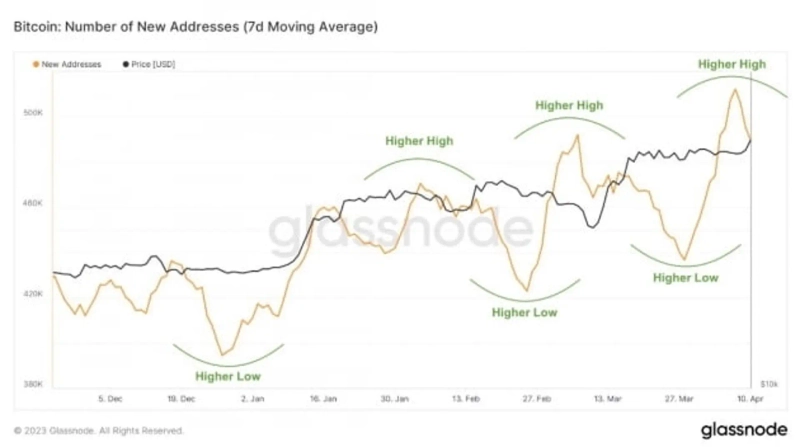

Indeed, according to on-chain analytics firm Glassnode, the number of new Bitcoin wallets on the Bitcoin network increased by 512,000 from the end of last month through the 10th, the highest level this year. Typically, an increase in new Bitcoin wallets tends to signal greater potential for Bitcoin prices to rise.

Bitcoin bullish if it breaks above $31,200 decisively…next resistance at $32,000

Market experts forecast that if Bitcoin breaks above $31,200, it could extend the current uptrend further. However, some caution that short-term volatility could intensify for the time being.

Aayush Jindal, an analyst at NewsBTC, said “Bitcoin has broken above $28,800, cited as a key resistance level, and is continuing higher,” adding that if Bitcoin breaks above $30,500 decisively, it is likely to move up in a strong advance to major resistances at $31,200 and $32,000 in turn.

He added that “if Bitcoin breaks below $30,250, it could fall to short-term support levels at $29,650 and $29,200.”

Tony Spilotro, an analyst at NewsBTC, said “Bitcoin has broken above $30,000 for the first time since June last year and has now established support around $30,000,” adding that “Bitcoin may see a short-term pullback, but the bullish trend will continue for several months.”

Tina Teng, a crypto analyst at CMC Markets, said “Bitcoin is maintaining its uptrend as the US banking crisis has raised the likelihood that the Fed’s rate-hike cycle is nearing completion,” adding that “technically, if Bitcoin continues its upward momentum, it could reach $35,000.”

Katie Stockton, founder of Fairlead Strategies and a well-known market analyst, said “(in the medium term) Bitcoin’s next resistance level is around $35,900 and support is estimated at $25,200.” She added that “Bitcoin’s short-term uptrend can reverse at any time,” urging investors to pay closer attention to risk management.

Some analysts also say caution is warranted as volatility could intensify given that liquidity in the crypto market has shrunk sharply. Connor Ryder, an analyst at Kaiko Research, said “Bitcoin liquidity fell to about half after last year’s FTX bankruptcy and has not yet recovered sufficiently,” adding that “if liquidity is scarce, volatility can rise. Investors should be wary of sharp downside moves.”

![2026-02-05 [Jarvis] 'PICK News Image 5 Citizen Reporter'](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)