‘Record net outflow’ for XRP ETF… “Selling pressure has intensified”

Summary

- U.S. spot XRP ETFs saw their first-ever weekly net outflow of about $41 million, with reports saying selling pressure has intensified.

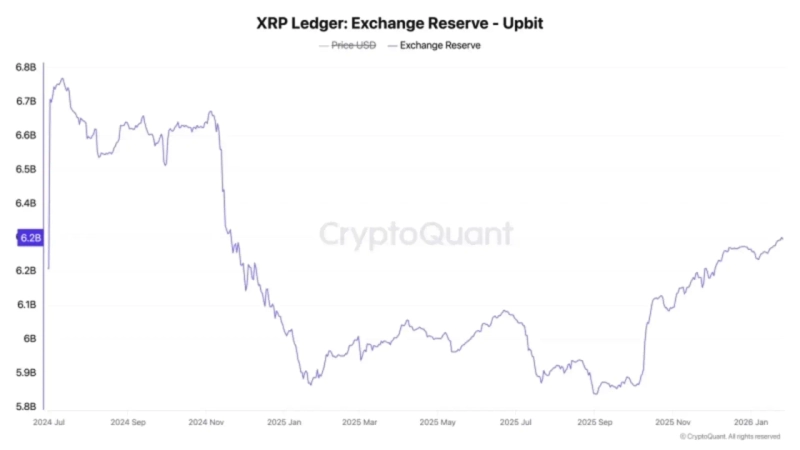

- Centralized exchange (CEX) XRP holdings at Binance and Upbit rose to recent highs, increasing the likelihood of stronger selling pressure ahead.

- Based on on-chain indicators, XRP may continue range-bound trading near $2, potentially lasting for an extended period until a major breakout.

A U.S. spot XRP exchange-traded fund (ETF) posted weekly net outflows for the first time since its launch. Sentiment toward XRP has also cooled in the derivatives market. Some observers say the token could trade sideways around $2 for the time being.

According to cryptocurrency analytics firm Sosovalue on the 27th (local time), about $41 million (about 60 billion won) flowed out of spot XRP ETFs last week on a net basis. This is the first time spot XRP ETFs have recorded weekly net outflows since listing in November last year. Total net assets, which had recently surged to $1.6 billion, also slid to $1.36 billion.

Spot XRP ETFs had initially held up relatively well even as Bitcoin and Ethereum ETFs saw outflows. Both spot Bitcoin ETFs and spot Ethereum ETFs logged monthly net outflows for three consecutive months from November last year through this month, extending a sluggish streak. That contrasts with spot XRP ETFs, which had sustained net inflows for nearly the past two months.

That changed starting on the 7th of this month. On that day, XRP ETFs recorded daily net outflows for the first time since launch. Inflows then stalled, and on the 20th, fallout from the U.S.-driven “Greenland shock” triggered net outflows of about $53 million in a single day. Analysts say the fact that XRP’s price has plunged nearly 20% from this month’s peak (about $2.4) has also added to profit-taking pressure.

XRP holdings on centralized exchanges (CEXs) are also rising. According to CryptoQuant, as of the previous day (the 26th), XRP holdings on Binance—the world’s largest cryptocurrency exchange—stood at about 2.72 billion tokens, the highest level in roughly two months since November last year. Upbit, South Korea’s largest cryptocurrency exchange, held about 6.3 billion XRP as of the previous day, setting a new high in about 1 year and 2 months since November 2024. Typically, rising exchange holdings are seen as increasing the likelihood of heavier selling pressure.

With conditions like these, the derivatives market has also contracted. Darkfost, a CryptoQuant contributor, said: “XRP open interest (OI) has steadily declined and recently fell below $500 million,” adding that “the downtrend has continued since the large-scale liquidation event in October last year.” In fact, XRP open interest has plunged by more than 70% over the past six months, from about 1.7 billion in July last year to about 500 million this month.

Analysts also say that strengthening fundamentals for Ripple’s dollar stablecoin RLUSD is insufficient to lift XRP’s upside momentum. RLUSD recently drew attention after being listed on Binance. Its market cap also jumped to about $1.33 billion as of the day, more than 13 times higher than a year ago (about $99 million). Kim Min-seung, head of Korbit’s Research Center, said, “There is no direct link between RLUSD listings or issuance growth and XRP’s value,” adding, “RLUSD usage has not yet stood out on-chain or in the real economy.”

Some also suggest XRP could be trapped in a range around $2. In particular, they note that on-chain indicators are showing a pattern similar to early 2022. U.S. crypto outlet Cointelegraph reported, “XRP moved sideways in the $0.3–$0.7 range for three years from 2022 to 2024,” adding, “If this pattern repeats, XRP could trade sideways near $2 for an extended period until a major breakout (Breakout·break above resistance) occurs.”

![2026-02-05 [Jarvis] 'PICK News Image 5 Citizen Reporter'](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)